By Bruce Huffaker, Publisher, North American Potato Market News

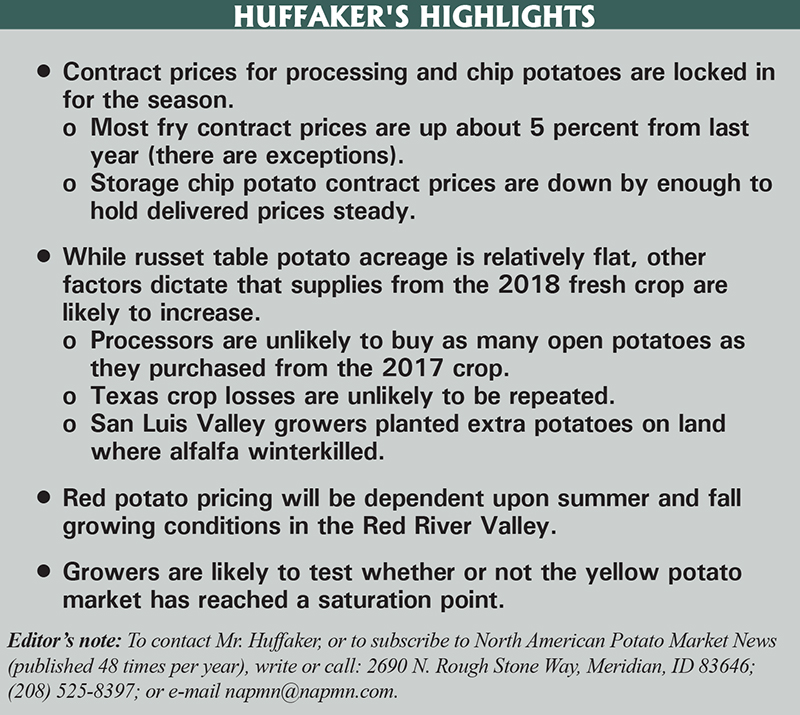

Early harvest of the 2018 potato crop is getting underway. Fall potato acreage almost certainly is up from last year, but some increase was needed to feed the new processing capacity that is coming online. How well growers matched planting with demand will be a key driving force for potato markets during the coming year, but other factors also will impact prices. The situation is different for each of the major industry sectors. In this article, we review the situation for each sector.

Frozen Processing

Fryers have contracted for almost all of their needs for the 2018 crop. Contract growers were able to negotiate higher prices, except for one contract in Idaho. Price increases for the 2018 crop were in the neighborhood of 5 percent in several growing areas. Some growers settled two-year deals, with 4 percent increases scheduled for 2019.

Though pricing is set, there are major differences between this year and 2017. First, fryers are unlikely to purchase as many potatoes on the open market as they did from the 2017 crop. In addition, there is a risk that processors have contracted for more potatoes than they will be able to use, particularly if construction and startup issues slow usage for some of the processing lines that are new this year. As is the case every year, strong yields could result in contract overages being pushed into other industry sectors.

Russet Table Potatoes

The market for the 2017 crop has been the strongest since the 2010 crop. Several factors played into that strength. Processors had to step into the Idaho market after cutting back on contract volumes, reducing the available supplies. The Texas storage crop suffered large losses due to a late-summer hailstorm. Supplies also fell short of last year’s holdings in Wisconsin, the San Luis Valley and the Columbia Basin.

Early indications are that table potato growers limited increases in 2018 acreage in spite of last year’s strong market. However, there is reason to fear that 2018 production will exceed demand. While it appears that Idaho growers may have held the line on acreage, it is unlikely that processors will need to raid the table potato market during the 2018-19 marketing season. That will free up more potatoes to be shipped fresh. In addition, San Luis Valley growers lost over 15,000 acres of alfalfa to winter kill. A substantial portion of that acreage has been planted to potatoes. While much of the increase is organic, it will add to the state’s supply. When the organic market gets flooded, growers move the surplus through regular market channels rather than dropping prices. Finally, there is no reason to expect a repeat of last year’s yield losses in Texas and in some of the other russet growing areas.

Red Potatoes

Burdensome supplies of storage potatoes in the Red River Valley have weighed on red potato prices for the last six months. That may leave prices at the start of the Big Lake, Minnesota, harvest well below year-earlier levels. The market tone in Big Lake will play a major role for pricing of red potatoes through the end of December or later.

In most recent years, Big Lake growers have managed to maintain reasonable prices throughout their marketing season. Red River Valley growers have tended to hold back until the central Minnesota harvest winds down before moving large volumes of potatoes. They may be leery of holding back following last year’s experience. Though other areas are growing more red potatoes, Red River Valley supplies tend to dictate pricing throughout the storage season. While acreage plays a role in the Valley’s production, yields and acreage loss (due to drowned out fields) can overwhelm the impact of acreage changes. Last year, growers managed to hold prices strong for much of the shipping season in spite of a large crop. However, the strong prices came at the expense of movement. Much of the storage crop had to be diverted to other uses because supplies backed up.

For the 2018 crop, growing and harvest conditions in the Red River Valley are likely to determine pricing during the storage season. Growers may be reluctant to hold back on shipping, to support prices, after their experience with the 2017 crop.

Yellow Potatoes

The retail market for yellow potatoes continued to grow during the 2017-18 marketing year. However, prices fell behind year-earlier values, and growers struggled with quality issues. Yellow potato acreage may be down in some areas this year, but growers in other areas are likely to continue the expansion. The big question for growers is whether the market for yellow potatoes has reached a saturation point, or whether last year’s price issues were related to quality problems. Growers are likely to be testing demand for yellow potatoes during the coming year.

Chip Potatoes

Storage contract volumes are similar to those for the 2017 crop. However, chip companies cut back on early-season contracts. That may allow field-delivery contracts in the storage states to clean up this year, rather than being converted into storage contracts. Chip companies are hoping to become less dependent upon early-season contracts from Florida and other growing areas due to difficulty finding trucks to move those potatoes. Reports indicate that storage contract prices to growers declined slightly this year, as chip companies worked to stabilize delivered prices, in spite of increased transportation costs.

Dehydration

Dehydrators rely on off-grade table potatoes for their major source of raw potatoes. However, that has not been sufficient to keep plants supplied in recent years. Processors have had to supplement raw product supplies with field-run contracts. Last year, they cut back on that source of raw product, with expectations that open market potatoes would be plentiful, and priced below contract values. That strategy didn’t work well. Therefore, contract volumes increased this year. If table potato production increases, as expected, raw product supplies are likely to be plentiful.

Yields will play a significant role in establishing open market prices for the 2018 potato crop. A review of historical data indicates that growers typically plant close to the right amount of potatoes to meet demand, at profitable price levels, based on their yield expectations. When yields exceed those expectations, prices tend to be weak. In years when yields fall short of expectations, the market is much stronger. It does not take much of a shift in yields to have a big impact on pricing.

On a national basis, the average deviation from trend over the past 20 years has been less than 7 cwt per acre, ranging from 10 cwt per acre below trend to 19 cwt per acre above trend. The average deviation is less than 2 percent, while the maximum deviation was 5.1 percent of the expected yield. The deviations, though small, can cause prices to double, or more, when yields are down, or to drop by 50 percent, or more, when yields exceed expectations.