Large crop in storage keeps prices low despite production declines

In the Northwest, excellent spring and early summer growing conditions were followed by heatwaves and heavy smoke in July and August, creating challenges for potato production. In Washington’s Columbia Basin and Oregon’s Klamath Basin, some fields are dying off earlier than usual, likely due to the intense July heat. This has slightly reduced yields. Parts of Idaho have also experienced reduced yields due to high temperatures. Despite ongoing concerns about water availability in Oregon and Idaho, summer rains have provided enough relief to likely sustain irrigation through the end of September.

Market conditions for potatoes are a mixed bag. While domestic demand remains steady, export markets have been sluggish, particularly in key Asian markets. In June, monthly exports decreased for the fourth consecutive year, dropping nearly 50 million pounds compared to the same period in 2023. National potato production is forecasted to decline by 3% year-over-year. However, this decline is likely insufficient to improve prices, as producers are still dealing with a large crop in storage. In the near-term it is unlikely that producer prices will rebound significantly, as processors face financial challenges from increased production costs and slowing restaurant demand.

Profitability September 11, 2024

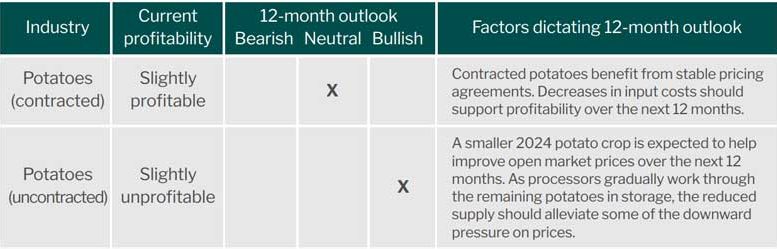

Potatoes (Contracted): Slightly profitable – Neutral 12-month outlook

Potatoes (Uncontracted): Slightly unprofitable – Bullish 12-month outlook

Contracted potatoes benefit from stable pricing agreements. Decreases in input costs should support profitability over the next 12 months.

A smaller 2024 potato crop is expected to help improve open market prices over the next 12 months. As processors gradually work through the remaining potatoes in storage, the reduced supply should alleviate some of the downward pressure on prices.

SOURCE: AgWest