|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

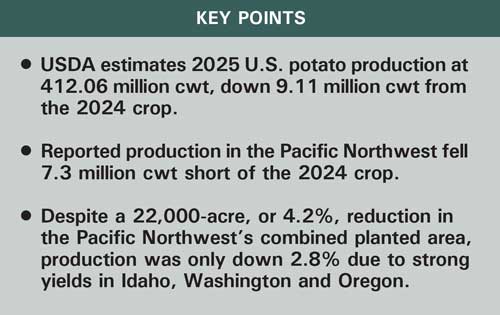

USDA estimates that growers produced 412.06 million cwt of potatoes during 2025. That is 9.11 million cwt less than the 2024 crop, a 2.2% decline. It is 1.7% below the five-year average production. Nine of the 13 reporting states posted reduced production relative to the previous year. USDA puts the year’s national average potato yield for the 2025 crop at 461 cwt per acre. That exceeds the 2024 average yield by 7 cwt per acre. USDA made several changes to its June acreage estimates for the various states. The net result was an 11,000-acre reduction in this year’s planted area to 901,000 acres. That is 31,000 fewer acres than growers planted in 2024. At 894,800 acres, the official harvested area fell 11,100 acres below USDA’s June forecast. In this article, we review the USDA data and explore the implications for frozen processing and other industry sectors.

Columbia Basin

USDA estimates that growers in Washington and Oregon planted a total of 181,000 acres of potatoes in 2025. That is 22,000 fewer acres than they planted in 2024. USDA reports that Washington growers planted 140,000 acres of potatoes in 2025. That is 5,000 acres under its June estimate. It trimmed Oregon’s planted area estimate by 2,000 acres, to 41,000 acres.

USDA put Washington’s average yield at 635 cwt per acre, 15 cwt per acre above the 2024-crop yield. It is the state’s largest yield since 2020. It is 21 cwt per acre above the five-year average. USDA also put Oregon’s average yield at 635 cwt per acre, up from 610 cwt for the 2024 crop. The combined changes result in a 114.62 million cwt potato crop in 2025. That is 10.44 million cwt less than the region produced in 2024, an 8.3% reduction.

Idaho

USDA reports that Idaho growers planted 315,000 acres of potatoes in 2025, which is unchanged from the June planted area estimate. It also matches the 2024 planted area. It estimates the average yield for the 2025 crop at 440 cwt per acre, up from 430 cwt for the 2024 crop. That is 11 cwt above the five-year average yield; however, it is 16 cwt below the long-term trendline yield. USDA put Idaho’s 2025 potato crop at 138.38 million cwt. That is 3.15 million cwt, or 2.3%, more than the 2024 crop. Idaho’s early-season shipping pace and current open-market prices suggest that USDA’s 2025 production estimate might be too low.

Upper Midwest

Combined production in the upper Midwest is estimated at 69.23 million cwt. That is only 372,000 cwt less than 2024 production, a 0.5% decline. USDA puts Wisconsin’s potato crop at 28.14 million cwt. That is 1.74 million cwt, or 6.6%, more than the 2024 crop. It reports that Wisconsin growers planted 68,000 acres of potatoes in 2025, 1,000 acres more than they planted in 2024. The state’s average yield is reported at 420 cwt per acre, up 20 cwt per acre from the 2024 yield.

North Dakota growers planted 70,000 acres of potatoes in 2025. That is 3,000 fewer acres than they planted in 2024, and it is 2,000 fewer acres than the USDA reported in June. The agency puts the state’s 2025 yield at 355 cwt per acre, 5 cwt per acre above the 2024 yield. USDA estimates North Dakota’s 2025 potato crop at 24.5 million cwt. That is 810,000 cwt, or 3.2%, less than 2024 production.

USDA now reports that Minnesota growers planted 40,000 acres of potatoes in 2025. That is 3,000 fewer acres than growers planted in 2024, and it is 1,000 fewer acres than it reported in June. It puts the state’s average yield at 420 cwt per acre, which matches the 2024 yield. With those adjustments, Minnesota’s 2025 potato crop is estimated at 16.59 million cwt. That is 1.3 million cwt less than the state produced in 2024, a 7.3% reduction.

Maine

At 17.25 million cwt, USDA’s November crop estimate puts this year’s potato crop 1.07 million cwt below 2024 production, a 5.9% reduction. USDA estimates that growers harvested 51,500 acres of potatoes in 2025, 2,400 fewer acres than they harvested in 2024. USDA put the state’s yield at 335 cwt per acre. That is 5 cwt less than the 2024 average yield.

Other States

Production in the other six states totaled 72.59 million cwt, down 0.5% from 2024 production. USDA puts Colorado’s 2025 potato crop at 23.02 million cwt. That is 958,000 cwt more than the state produced in 2024, a 4.3% increase. Michigan’s potato crop is estimated at 20.21 million cwt, down 1.1% from the 2024 crop. USDA puts Nebraska’s 2025 potato crop at 9.95 million cwt. That is 187,000 cwt, or 1.8%, than 2024 production. California’s 2025 potato crop is estimated at 8.56 million cwt, down 387,000 cwt, or 4.3%, from the previous year. At 6.21 million cwt, USDA’s Texas potato crop estimate falls 584,000 cwt short of 2024 production, an 8.6% reduction. USDA puts Florida’s 2025 potato crop at 4.65 million cwt. That is 1% more than the state produced in 2024.

Summary

Despite significant contract volume reductions for the 2025 crop, raw-product supplies for frozen processing appear to be above budget again this year due to strong yields in most major processing regions of North America. Reports indicate that yields were exceptional for early varieties in the Columbia Basin and in Idaho. Though total production in the Pacific Northwest is down from 2024, it is more than sufficient for local processing needs. Fryers were purchasing contract overages during harvest, but those procurements have mostly ceased. The Midwest processing states should have an adequate supply of raw product to run plants at desired levels this year. In Canada, Prince Edward Island processors have already purchased production overages from Maine and other areas to cover their supply gap. Overall, the quality of this year’s processing potato crop is average or slightly above average, which should support favorable finished product recover rates.

Dehydrators have large supplies of finished product in storage. As a result, there is currently very little demand for off-grade potatoes. A substantial volume of potatoes that would normally be used for dehy processing have been dumped or diverted to cattle feed.

Chip potato supplies appear to be more than sufficient for industry needs. Reported U.S. chip potato shipments from the 2025 crop have been running well below the 2024 pace.

Idaho growers increased russet table potato acreage this year. In addition, strong yields boosted production in Idaho, Wisconsin and Colorado’s San Luis Valley. Russet table potato production appears to be relatively stable in the Columbia Basin, Texas and Michigan. Strong early-season movement from Idaho has offset shipments from other areas. Marketers are struggling to compete with Idaho’s low prices. Table potato supplies are backing up in several regions.