|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

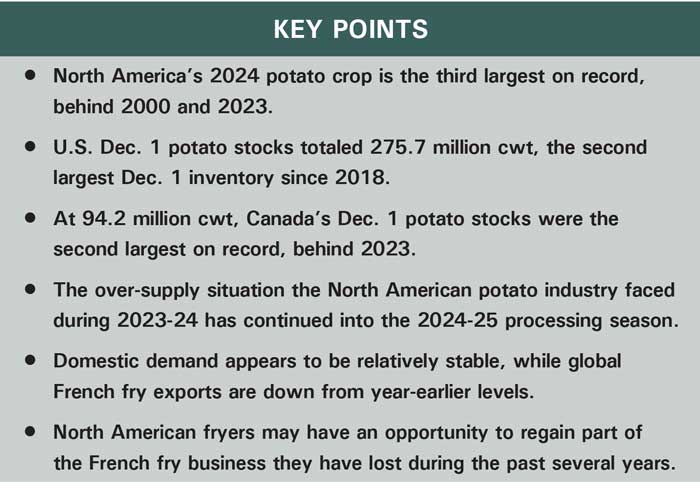

U.S. and Canadian growers produced 544.81 million cwt of potatoes during 2024. That is 21.91 million cwt, or 3.9 percent, less than 2023 production. The U.S. potato crop accounted for all the reduction. U.S. production is estimated to be down 5.1 percent from the 2023 crop. Canada’s 2024 crop is estimated to be 0.3 percent larger than the 2023 crop. Dec. 1, 2024, stocks data, for both the U.S. and Canada, highlight several challenges and opportunities for the potato industry during the remainder of the storage season. In this article, we provide a brief outline of the raw-product supply situation for the North American frozen processing industry.

US Supply Situation

USDA estimates that potato growers produced 417.85 million cwt of potatoes during 2024. That is 22.28 million cwt less than the 2023 crop. It nearly matches the five-year average production. Growers in the storage states held 275.7 million cwt of potatoes on Dec. 1. That is 10 million cwt less than those states had in storage a year earlier, a 3.5 percent reduction.

USDA puts Idaho’s 2024 potato crop at 135.24 million cwt. That is 8.1 million cwt, or 5.6 percent, less than 2023 production. Idaho’s Dec. 1 potato stocks totaled 94 million cwt. That is 6 million cwt, or 6 percent, less than the year-earlier inventory. Idaho processors used 25.69 million cwt of potatoes from the 2024 crop prior to Dec. 1, 395,000 cwt less than they used from the 2023 crop during the same period, a 1.5 percent downturn. The Pacific Northwest’s large carryover from the 2023 crop reduced the need for new-crop processing potatoes.

USDA reports that Washington growers produced 99.65 million cwt of potatoes in 2024. That is 3.98 million cwt less than the state produced in 2023, down 3.8 percent. Dec. 1 potato stocks totaled 60 million cwt, according to USDA. That is 1 million cwt less than year-earlier holdings, a 1.6 percent reduction. It is Washington’s third largest Dec. 1 inventory on record (behind 2023 and 2019). USDA reports that processors used 24.44 million cwt of new-crop potatoes prior to Dec. 1. That is 365,000 cwt less than they used during the same timeframe a year ago.

Oregon’s 2024 potato crop totaled 26.25 million cwt, which is 410,000 cwt, or 1.5 percent, less than the 2023 crop. At 20.7 million cwt, Oregon’s Dec. 1 potato stocks are down 300,000 cwt, or 1.4 percent, from year-earlier holdings. USDA reports that early-season processing use totaled 12.82 million cwt. That is 2.26 million cwt less than year-earlier usage, a 15 percent decline.

Dec. 1 stocks in the other processing states are mixed. At 17 million cwt, Wisconsin’s reported Dec. 1 potato stocks fell 2.3 million cwt, or 11.9 percent, below the year-earlier inventory. North Dakota had 17.2 million cwt of potatoes in storage on Dec. 1, 11.8 percent less than it held in 2023. Maine had 13.6 million cwt of potatoes left in storage on Dec. 1, 12.4 percent more than the year-earlier inventory. Minnesota had 12.2 million cwt of potatoes left in storage on Dec. 1, down 0.8 percent from the previous year.

North American Potato Market News estimates that U.S. processors used 67.29 million cwt of potatoes from the 2024 potato crop for purposes other than dehydration (mostly French fry production) prior to Dec. 1. That fell 1.17 million cwt short of the 2023 pace, a 1.7 percent decline. It followed a 2.91 million cwt, or 11.3 percent, increase reported for late-season usage from the 2023 crop. Estimated June-November disappearance in this category totaled 95.98 million cwt. That exceeded June-November 2023 usage by 1.73 million cwt, or 1.8 percent. The increase in June-November processing suggests that fry plants got off to a better start than they did the previous year. If the stocks data are correct, total Dec. 1 stocks in the Pacific Northwest are down only 4 percent from a year earlier. That leaves more than enough potatoes to run PNW plants at capacity. Fryers in the Midwest and Maine also have access to an adequate supply of raw product. Nevertheless, some French fry plants continue to run below capacity, while others are expected to take extended downtime during the next several months.

Canadian Supply Situation

Canada’s 2024 potato crop is the largest on record. Canadian growers produced 126.97 million cwt of potatoes in 2024. That exceeded the 2023 crop by 372,000 cwt. The country had 93.8 million cwt of potatoes in storage on Dec. 1. That fell 302,000 cwt short of year-earlier holdings, a 0.3 percent reduction. The Dec. 1 inventory nearly matched the previous year’s inventory, which was the largest on record. It is 11.9 percent more than the five-year average. Stocks are down from last year in Alberta and Manitoba, but they are up in Prince Edward Island, New Brunswick and Quebec. Processing potato stocks fell 1 percent short of December 2023 holdings.

At 23.03 million cwt, Alberta’s Dec. 1 potato stocks fell 2.86 million cwt, or 11.1 percent, below last year’s record-large inventory. Intended use data show that the province’s processing potato stocks are down 2.54 million cwt, or 12.3 percent, to 18.09 million cwt. That is 13.9 percent more than the three-year average supply. Manitoba had 19.31 million cwt of potatoes in storage on Dec. 1. It includes 15.59 million cwt of processing potatoes, down 1.89 million cwt, or 10.8 percent, from last year’s record inventory. Ag Canada reported Quebec’s Dec. 1 inventory at 10.14 million cwt, up 858,000 cwt, or 9.2 percent, from December 2023. At 4.02 million cwt, processing stocks are up 18.2 percent from the previous year. New Brunswick had 12.2 million cwt of potatoes left in storage on Dec. 1. That is 2.59 million cwt more than year-earlier holdings, a 27 percent increase. At 8.01 million cwt, New Brunswick’s processing potato stocks are up 2 million cwt, or 33.3 percent, from the 2023 inventory. That leaves the province with its fourth largest processing potato inventory on record. Prince Edward Island held 20.03 million cwt of potatoes in storage on Dec. 1. That is 1.23 million cwt more than year-earlier holdings, a 5.9 percent increase. At 14.14 million cwt, Prince Edward Island’s processing potato stocks exceeded the year-earlier inventory by 1.13 million cwt, or 8.6 percent.

The French fry producing provinces held a combined 58.42 million cwt of frozen processing potatoes on Dec. 1. That is 792,000 cwt, or 1.3 percent, less than last year’s record inventory. All the supply reductions came in Manitoba and Alberta. Fryers in those provinces cut contract volumes for the 2024 crop after the over-supply situation created by the record-large 2023 potato crop. Nevertheless, yields for the 2024 crop remained near record levels in the Prairie Provinces. Supplies are down, but less than expected. Favorable growing and harvesting conditions boosted processing potato production in Prince Edward Island, New Brunswick and Quebec.

Conclusion

The massive over-supply situation the North American potato industry faced during 2023-24 has continued into the 2024-25 processing season. Despite the many internal challenges, there are a few opportunities. Domestic demand for French fries and other frozen products remains relatively stable. Industry data indicate that buyers purchased 0.4 percent more U.S. frozen product between June and November than they did during the same period in 2023.

On the other hand, global French fry exports are down 2.7 percent for the year ending Oct. 31, 2024. Canada’s August-October French fry exports totaled a record 784.86 million pounds, up 10.2 percent from year-earlier movement. Most of the extra shipments have gone to the U.S. (up 8.9 percent), though sales to offshore markets jumped by 19.7 percent during the period. Canada may continue to ramp up the export pace during the remainder of the season.

Given the current raw-product supply situation, North American fryers are in a position to expand finished product supplies this year. However, Europe’s offshore exports could expand significantly with the 2024 potato crop, which is 7.2 percent larger than the 2023 crop. North American fryers have an opportunity to expand their domestic and offshore French fry business, but there are several challenges and competition from EU processors will be strong this year.