|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

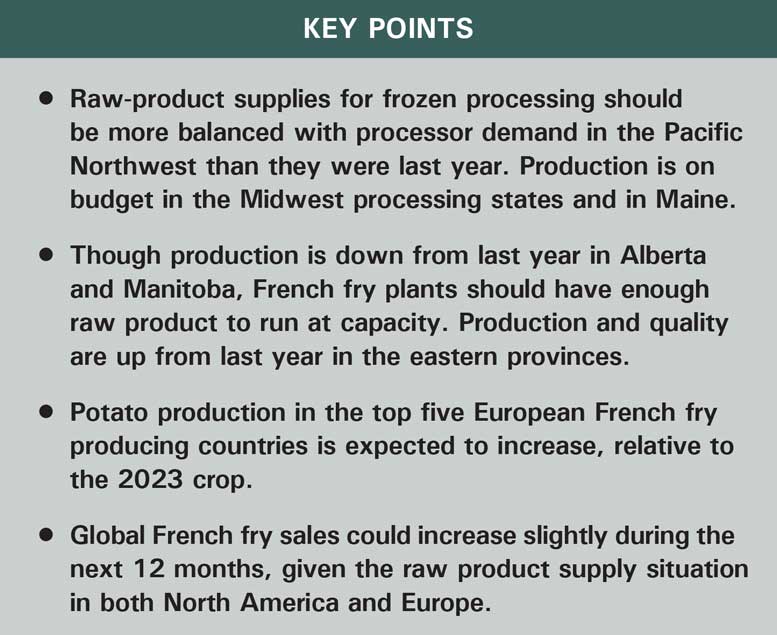

Potato production is down from last year in several of the major processing regions of North America. Europe’s 2024 potato crop is expected to increase, relative to the previous year. In this article, we explore the North American and European frozen processing potato supply situation and its potential impact on frozen product sales and consumption.

US Supply Situation

U.S. potato production (as of press time) is expected to fall by approximately 4 percent, relative to the 2023 crop. If realized, the 2024 potato crop would be 0.6 percent larger than the five-year average. In the Columbia Basin, production will likely fall 8 to 9 percent below the 2023 crop. Growers and processors indicate that the quality and size of this year’s main potato crop is average. There is more variation in the storage crop than usual, which may be due to the extensive heat during July and August. On the other hand, both yields and quality for earlier-harvested potatoes were above average.

Idaho growers planted 5,000 fewer acres than they planted in 2023, according to USDA estimates. Reports from growers across Idaho suggest that this year’s potato crop is mixed. Overall, growers indicate that yields are close to, or below, the five-year average. If our forecast is accurate, Idaho’s production could fall 2 to 3 percent short of the 2023 crop. It would be Idaho’s second largest potato crop since 2019.

Frozen processing supplies are expected to be on budget in the Midwest processing states. Midwest growers experienced mostly favorable harvest conditions this year. Growers in Minnesota and North Dakota report slightly above average yields, while Wisconsin’s yields are down from the 2023 crop. Recovery rates also could be down in Wisconsin due to quality issues caused by excessive rain early in the growing season.

Maine should have an ample supply of potatoes for processing. The state experienced nearly ideal growing and harvest conditions, though the potato crop needed a little more late-season rain to finish bulking. Yields are down slightly from the 2022 record. Growers and processors are pleased with the quality of this year’s crop.

Though production is down from last year in Idaho and the Columbia Basin, raw-product supplies should be sufficient to run U.S. plants near capacity this year.

Canadian Supply Situation

Canada is expected to produce its second largest potato crop on record, behind the 2023 crop. Raw-product supplies for frozen processing are expected to be down from last year’s bumper crop. We expect combined production in Alberta and Manitoba to fall 10 to 11 percent below the 2023 crop. In the eastern part of the country, production is expected to increase in Prince Edward Island, New Brunswick and Quebec. However, frozen processing supplies could still be tight in Prince Edward Island. The eastern provinces have avoided many of the quality issues that plagued the 2023 crop. Recovery rates will be up from last year. Despite the downturn in potato production, Canadian fryers should have enough raw product to operate plants at capacity through the 2024-25 processing season. U.S. fryers may not need to import Canadian potatoes for frozen processing this year due to ample supplies in most of the processing states.

European Supply Situation

Growers in the EU’s top five French fry exporting countries – Belgium, the Netherlands, France, Germany and Poland – planted more potatoes this year than they did in 2023. Current estimates are that the five major exporting countries planted a combined 2.4 million acres of potatoes this year, 6.9 percent more than they planted in 2023, according to “World Potato Markets,” a European publication. The EU’s MARS crop monitoring service expects yields to fall short of 2023 levels in Germany, the Netherlands, Belgium and Poland. However, they are projected to match the 2023 average yield in France. Based on those acreage and yield estimates, the top five European exporting countries are expected to produce 833.5 million cwt of potatoes for the 2024 crop. That is 30.2 million cwt more than those countries produced in 2023, a 3.8 percent increase. October rain slowed harvest progress across much of Europe, especially in Belgium, but conditions improved during the first few weeks of November.

Impact on French Fry Sales

North American fryers were unable to significantly expand global French fry sales during the past 12 months, even though there was a surplus of raw product available. North American fryers shipped 0.1 percent more frozen potato products to offshore markets during the year ending Aug. 31 than they did a year earlier. Though North American potato production is down from last year, raw product supplies appear to be more balanced with processor demand than they were during the 2023-24 processing season.

EU frozen product sales were held back by raw product supply constraints last year. EU exports were down 3.6 percent during the year ending Aug. 31. However, production is up for the 2024 crop. Both North American and European fryers could produce more French fries and other frozen potato products during the 2024-25 processing season.

Though global French fry exports were down during the 12 months ending Aug. 31, demand growth has been relatively steady. Global exports have grown by an average of 4.1 percent per year during the past 10 years. Raw product supplies should be adequate in the major processing regions for a 1 to 3 percent increase in sales. However, market constraints and global economic uncertainty may hold production and sales from the 2024 crop below our estimate.