|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

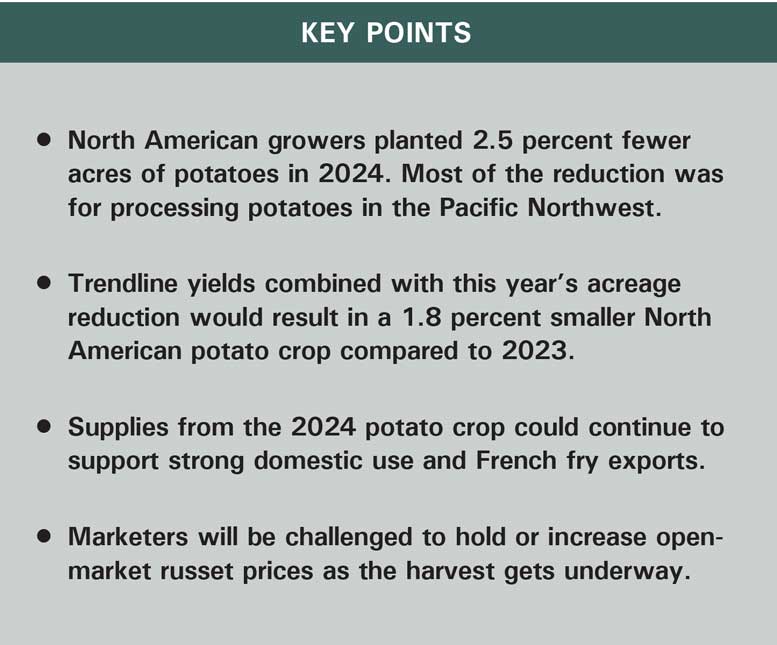

USDA reports that U.S. growers planted 941,000 acres of potatoes in 2024. That is 24,000 fewer acres than they planted a year ago, a 2.5 percent reduction. The largest reported reductions came in Washington, Idaho and Oregon.

Preliminary data from Canada show that growers in that country planted 393,592 acres of potatoes this year. That is down 3,610 acres, or 0.9 percent, from the 2023 potato area.

The combined North American potato area is 1.335 million acres, down 27,610 acres, or 2 percent, from the 2023 crop. Since 2020, Canadian potato acreage has expanded by 9.1 percent, while U.S. potato acreage increased by 2.3 percent relative to 2020 levels. Overall, the total North American potato acreage is 54,226 acres more than it was for the 2020 crop.

Abandonment

USDA projects this year’s harvested area at 937,200 acres. That is 23,000 fewer acres than growers harvested in 2023, a 2.4 percent decline. A year ago, U.S. growers abandoned 4,800 acres of potatoes, 0.5 percent of the planted acreage. During the previous five years, abandonment has averaged 1.2 percent of the U.S. potato area.

Canadian growers abandoned 10,131 acres of potatoes during 2023 due to heavy rainfall in the eastern provinces and limited storage space in Alberta. That was 2.6 percent of all potatoes planted. Abandonment averaged 1.3 percent during the previous three years. Because there have been only a few reports of abandonment so far this growing season, we have held our estimate of Canadian abandonment at 1.5 percent. Canada’s 2024 harvested area would be 387,688 acres.

Based on these harvested acreage estimates, the combined North American 2024 harvested acreage would be 1.325 million acres, down 1.7 percent from 2023 levels.

Yields, Potential Production

The U.S. long-term trend yield is 461 cwt per acre. That is up from the current estimate for last year’s yield, 459 cwt per acre. Using the trend yield and projected abandonment, the U.S. would be expected to produce 432.5 million cwt of potatoes during 2024. That is 8.3 million cwt, or 1.9 percent, less than 2023 production. If realized, the 2024 potato crop would be 3 percent larger than the five-year average.

Canada’s average potato yield has increased by about 3.6 cwt per acre per year for the past 10 years. The trend yield for the 2024 crop is 327.5 cwt per acre. The current yield estimate for last year’s crop is 332.8 cwt per acre, 5.3 cwt above trendline. With a trend yield and estimated abandonment, Canada would produce a 127 million cwt crop during 2024. That would fall 1.8 million cwt, or 1.4 percent, short of 2023 production.

North American potato production could decline slightly, given this year’s acreage reduction. Estimated abandonment and trend yields suggest that North America’s 2024 potato crop could total 559.4 million cwt. That would fall 10.1 million cwt, or 1.8 percent, below 2023 production. However, it would be 23.1 million cwt, or 4.3 percent, more than the five-year average production for the U.S. and Canada combined.

Using trendline yields and average abandonment is a good place to start estimating total production. It only takes average growing conditions to produce a trendline yield. However, there are many other factors that can and will impact potato production between the time I write this article and the time you read it. A lot can happen before harvest is complete.

Spring planting conditions were mostly favorable across North America. Growers in several major growing regions were able to plant a week or two earlier than usual. As a result, crop development is ahead of schedule in most areas. Early-summer growing conditions were nearly ideal in Idaho and in the Columbia Basin; however, the July heat wave probably held back yields. Spring rains improved the irrigation situation in Alberta, though water supplies are still extremely tight. Growing conditions in the Prairie Provinces have been mostly favorable, but growers do not expect a repeat of last year’s record-breaking yields. Considering these factors, North American potato production could end up on either side of trend yield projections.

Potential Price Impacts

Frozen processing raw product supplies have been plentiful as the industry transitions to the 2024 crop. French fry and other frozen product sales have been relatively strong. Fryers reduced Pacific Northwest contract volumes for the 2024 crop, especially for early-harvested varieties. Growers in Idaho, Washington, Oregon and Alberta planted 22,600 fewer acres of potatoes than they did a year ago, a 3.7 percent reduction. USDA reports that Idaho reduced potato acreage by 5,000 acres. Washington and Oregon cut back acreage by 10,000 acres and 3,000 acres, respectively. Alberta planted 4,600 fewer acres of potatoes this year. Contract volumes and processing acreage appear to be relatively stable in most other areas, though Manitoba growers reduced their planted area by 2,400 acres.

Below break-even open-market prices have encouraged growers in the Pacific Northwest and other areas to cut back on russet potato production. However, if USDA’s planted area estimates are correct, russet table potato supplies could be abundant during the 2024-25 marketing year. Growers in the Pacific Northwest planted 18,000 fewer acres of potatoes than they did last year. Trendline yields would result in a 2.8 percent reduction in Pacific Northwest potato production. Idaho’s 5,000-acre reduction combined with a trend yield would boost that state’s total production to 145.1 million cwt, slightly larger than the 2023 crop. Canadian growers did not cut back significantly on russet table potato acreage in 2024. Canada’s russet table potato production could increase if yields rebound in Prince Edward Island, New Brunswick and Quebec. Marketers will be challenged to hold and/or increase prices during August and September as the harvest gets underway.

Summary

Most of this year’s reduction in potato acreage is for processing potatoes. Demand and production are down for early processing varieties. Abundant raw product supplies from the 2023 crop have supported an increase in both domestic frozen product usage and French fry exports. French fry production could continue to increase during the next 12 months. However, economic uncertainty and consumer demand will likely have a large impact on sales.