|

Click to listen to this article

|

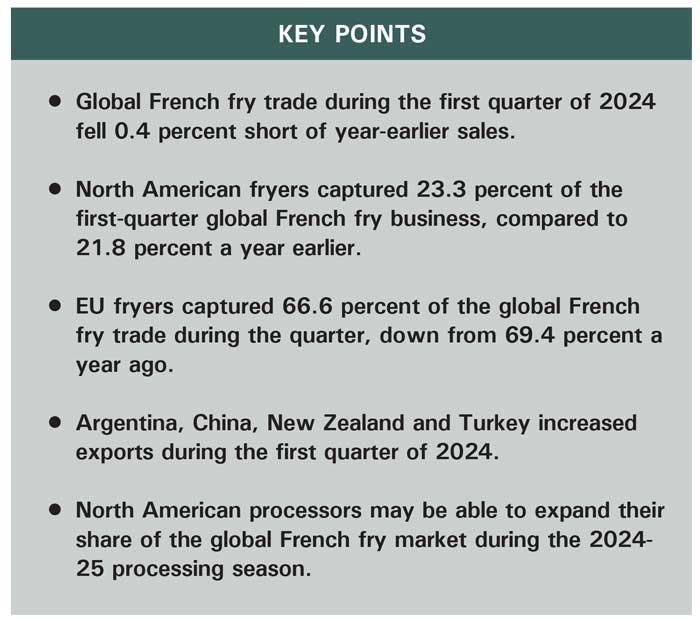

By Ben Eborn, Publisher, North American Potato Market News

The world’s major French fry producers shipped 2.439 billion pounds of French fries and other frozen potato products to customers outside of their local trading zones during the January-March quarter. That is 9 million pounds, or 0.4 percent, less than the year-earlier export volume. Seven of the 11 French fry exporting countries that we track posted increases relative to 2023. Only the Netherlands, Poland, Germany and Belgium saw volume reductions during the quarter. Several smaller exporters such as Canada, China, France, New Zealand and Turkey reported double-digit percentage increases in first-quarter sales. (Please note that trade data reported exclude trade between the U.S. and Canada, intra-EU trade, and Chinese exports to Hong Kong and Macao). Trade data show volume increases in French fry purchases by six of the top 10 major importers. However, four major importers, the United Kingdom, Japan, the United States and Australia, reduced purchases during the quarter. In this article, we review global French fry trade by major exporters during the first quarter of 2024.

European External French Fry Exports Down 4.4 Percent

EU fryers shipped 1.624 billion pounds of French fries and other frozen potato products to external customers during the first quarter. That fell 75.2 million pounds, or 4.4 percent, short of year-earlier sales. The two largest French fry exporters, Belgium and the Netherlands, reduced shipments during the quarter. Belgium’s exports totaled 938.5 million pounds, down 6.2 million pounds, or 0.7 percent, from last year. At 528.1 million pounds, exports from the Netherlands dropped by 71.1 million pounds, or 11.9 percent. France’s first-quarter exports climbed by 20.7 million pounds to a record 79.4 million pounds. Germany’s exports fell by 8.1 million pounds to 43.4 million pounds. Poland’s first-quarter sales dropped 10.6 million pounds below 2023 sales to 35.1 million pounds. EU fryers captured 66.6 percent of the global French fry business, down from 69.4 percent a year ago.

North American French Fry Sales to Offshore Markets Up 6.8 Percent

North American fryers shipped 569.4 million pounds frozen potato products to offshore markets during the first quarter of 2024. That is 36.2 million pounds more than the year-earlier export volume, a 6.8 percent increase. Following a 6.73 percent decline in January, February offshore exports exceeded the 2023 pace by 14.1 percent. French fry exports maintained that upward trend during March, climbing 13.9 percent above year-earlier shipments. The increase in Canadian offshore sales accounted for 85.1 percent of the first-quarter export growth. U.S. fryers exported 456.4 million pounds of frozen potato products during the quarter. That is 5.6 million pounds more than they exported during the same timeframe in 2023, a 1.2 percent increase. Canada exported 113.1 million pounds of French fries and other frozen products to offshore markets during the first quarter. That exceeded year-earlier sales by 30.6 million pounds, or 37.2 percent. North American fryers captured 23.3 percent of the first-quarter global French fry business, up from 21.8 percent during the first quarter of 2023.

Exports Increase From Argentina, China, New Zealand, Turkey

Smaller exporting countries combined to ship 14 percent more frozen product during the first quarter than they exported a year earlier. Argentina exported 98 million pounds of French fries during the first quarter of 2024. That is 2.7 million pounds more than year-earlier sales, a 2.8 percent increase. Argentine fryers captured 4 percent of the global French fry export business during the quarter.

China exported a record 87.4 million pounds of frozen potato products outside of greater China during the first quarter of 2024. That is 10.5 million pounds more than it exported a year earlier, a 13.6 percent increase. China’s share of the global French fry market rose to 3.6 percent from 3 percent in 2023. External exports have grown significantly during the past five years. French fry exports totaled just 3.6 million pounds during the first quarter of 2019.

New Zealand exported 32 million pounds of French fries during the first quarter. That exceeded year-earlier sales by 5.3 million pounds, or 19.7 percent. New Zealand captured 1.3 percent of the global market.

Turkey has become a major French fry exporter during the past six years. The country exported 27.5 million pounds of frozen potato products during the first quarter. That is 11.7 million pounds, or 73.9 percent, more than year-earlier sales. Turkey captured 1.1 percent of the first-quarter global French fry business.

North American Fryers Could Continue to Expand Their Market Share

Global French fry exports have grown by an average annual rate of 5.2 percent during the previous 10 years. European exports have been held back by raw-product supply constraints during the 2023-24 processing season. EU processors are planning to resume export growth when the 2024 crop comes online. Combined acreage in the five major European exporting countries is expected to increase by 2-3 percent for the 2024 crop. European growers have had a challenging planting season. Much of this year’s potato crop was planted later than usual due to heavy rainfall.

On the other hand, most North American processors have access to an adequate supply of raw product from the 2023 crop. Three of the four North American fryers are running plants at capacity and have had to turn away business. Those processors could run out of contracted potatoes earlier than expected. Some open-market potatoes have been purchased recently at relatively low prices.

Though we don’t have official acreage reports as of press time, we expect the North American growers to plant 3-5 percent fewer acres to potatoes this year. Nevertheless, planting and crop development are ahead of schedule in most of the major processing states and provinces. That could support strong yields for the 2024 potato crop. The new-crop potato harvest is expected to get underway in the Columbia Basin during the week of July 15. The situation is complex, but long-term trends suggest that global French fry demand growth will likely continue. That may give North American fryers an opportunity to expand their share of the global French fry market.