|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

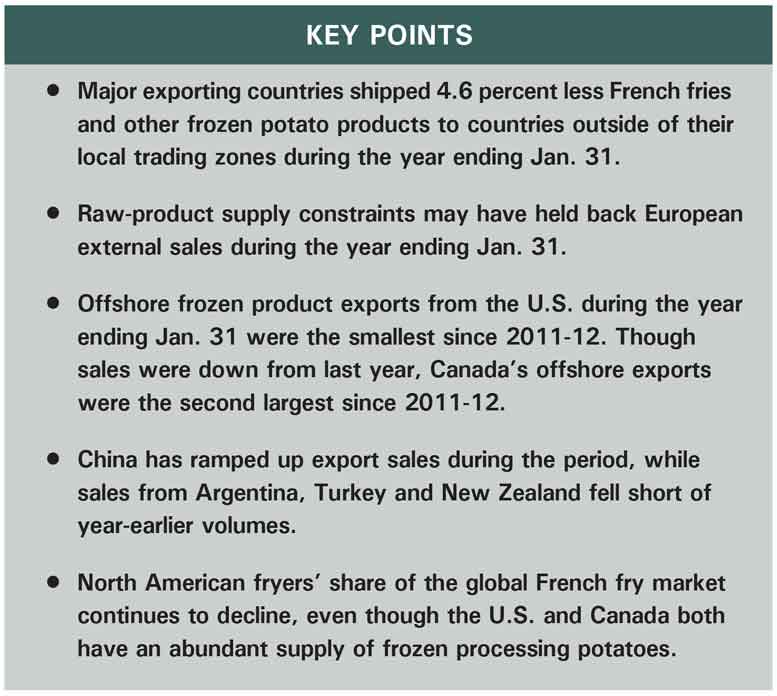

Major exporting countries shipped a record 9.433 billion pounds of French fries and other frozen potato products to countries outside of their local trading zones during the year ending Jan. 31, 2024. That is 450 million pounds less than year-earlier shipments, a 4.6 percent decline. Limited raw-product supplies held back sales from the EU; offshore exports fell 1.2 percent short of the year-earlier sales volume. Offshore sales from U.S. fryers dropped 13.6 percent below 2022-23 levels despite this year’s large raw product oversupply situation.

In addition, sales from smaller exporters such as Canada, Argentina, New Zealand and Turkey dropped off during the period. Their combined external frozen product sales were down 14.5 percent during the year ending Jan. 31. On the other hand, frozen product exports from China increased 36.5 percent.

In this article, we explore global French fry trade by major exporter as well as the trade outlook for the next 12 months.

European External French Fry Exports Down 1.2 Percent

European fryers exported 6.351 billion pounds of French fries and other frozen potato products to customers outside the EU during the year ending Jan. 31. Exports to external customers fell 79 million pounds short of year-earlier sales, a 1.2 percent decline. Six of the EU’s top 10 external customers reduced their purchases of French fries and other frozen product during the year ending Jan. 31. The largest volume reductions came in sales to Brazil (-86 million pounds), Columbia (-30 million pounds) and Saudi Arabia (-24 million pounds). In addition, the United Kingdom, Jordan, Malaysia, South Korea, the Philippines and Russia each reduced purchases by 20-23 million pounds during the period.

The United States, the third largest importer of EU French fries, increased its purchases by 35 million pounds, or 7.4 percent, relative to a year earlier. Australia increased its imports by 103 million pounds, or 55.3 percent, during that timeframe. EU processors captured 67.3 percent of the global market. That is up from 65.1 percent in 2022-23 and 64.5 percent in 2021-22.

North American French Fry Sales to Offshore Markets Down 12 Percent

North American fryers shipped 2.14 billion pounds of frozen potato products to offshore markets during the year ending Jan. 31. That is 291 million pounds less than year-earlier shipments, a 12 percent downturn. Frozen product export volumes fell short of year-earlier sales to eight of the top 10 customers. U.S. frozen product exports dropped by 13.6 percent, while Canadian offshore exports fell by 3.3 percent during the period.

Japan, the largest customer, took 590 million pounds of product, 59 million pounds or 9.1 percent less than year-earlier purchases. Mexico reduced its imports by 7.4 percent, to 503 million pounds. Exports to South Korea dropped by 20.6 percent, to 170 million pounds. Sales to Taiwan rose by 0.4 percent, while exports to the Philippines fell 8 percent short of year-earlier shipments. Frozen product exports to the remaining 82 customers dropped 18.2 percent below year-earlier levels.

Raw-product supplies are abundant in both the U.S. and Canada. Nevertheless, exports during the year ending Jan. 31 were the second smallest since 2012-13 (behind 2020-21). North American fryers captured 22.7 percent of the global market, which is down from 24.6 percent in 2022-23 and 24.8 percent in 2021-22.

Mixed French Fry Exports From Argentina, China, Turkey, New Zealand

Argentina exported 385 million pounds of French fries during the year ending Jan. 31. That is 103 million pounds less than year-earlier sales, a 21.2 percent decline. Argentina’s global market share was 4.1 percent, down from 4.9 percent a year earlier. Brazil is Argentina’s main customer.

China continued to ramp up French fry exports during the year ending Jan. 31, to 296 million pounds. That is 79 million pounds more than year-earlier sales, a 36.5 percent increase. Exports have nearly tripled during the past two years. China is becoming a major player in the global French fry export trade. China has a 3.1 percent share of the global French fry market, up from 2.2 percent in 2022-23 and 1.1 percent in 2021-22. China’s major customers include the Philippines, Japan, Indonesia, Thailand and South Korea.

Turkey also has become a major French fry exporter during the past several years. The country exported 145 million pounds of frozen potato products during the year ending Jan. 31. That is 51 million pounds, or 26.2 percent, less than year-earlier sales. Turkey captured 1.5 percent of the global French fry business during the period, down from 2 percent a year earlier. Turkey’s major customers include Russia, Iraq and China.

New Zealand exported 117 million pounds of French fries during the year ending Jan. 31. That is 5 million pounds less than year-earlier sales, a 3.9 percent reduction. New Zealand captured 1.2 percent of the global market during the period, unchanged from a year earlier. Most of New Zealand’s French fry exports go to Australia and Thailand.

Will Global French Fry Trade Grow in Next 12 Months?

Global offshore French fry exports have grown by an average of 5.1 percent per year during the previous 10 years. However, global sales dropped by 4.6 percent during the year ending Jan. 31, 2024. Global French fry exports, during the year ending Jan. 31, only declined one other time during the past 20 years. During 2020-21, the year of the pandemic, external exports dropped by 12 percent. Frozen product exports reached a record 9.884 billion pounds during 2022-23, despite raw-product supply constraints in the European Union and in the United States. The North American raw-product supply situation has reversed with the harvest of the 2023 crop.

Nevertheless, exports continue to decline, and North American fryers continue to lose their market share. Several factors may be contributing to the downturn. Domestic demand appears to be relatively strong both in North America and in the European countries. Overall economic growth may be slowing in some of the key importing countries. In addition, one fryer’s marketing strategy change may have impacted North America’s export sales.

Trends suggest that long-term global French fry demand growth is likely to continue. Raw-product supplies are abundant for North American fryers and probably won’t be a limiting factor during at least the first part of the 2024-25 processing season. Sales from North America could pick up. EU French fry processors are likely planning to resume export growth when the new crop becomes available.