|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

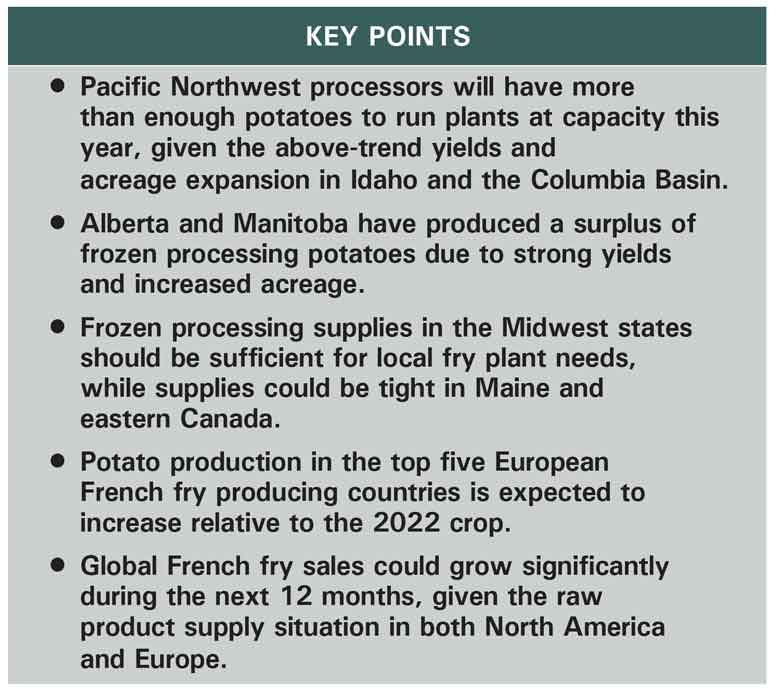

Potato production has exceeded industry expectations in the major processing regions of North America. Europe’s 2023 potato crop is also expected to increase relative to the previous year. In this article, we explore the North American and European frozen processing potato supply situation and its potential impact on frozen product sales and consumption.

US Supply Situation

U.S. potato production (as of press time) is expected to increase by 9 to 10 percent relative to the 2022 crop. If realized, it would be the largest U.S. potato crop since 2000. In the Columbia Basin, production will likely exceed the 2022 crop by 3 to 4 percent. The yields and quality for later-harvested potatoes have been excellent. On the other hand, yields on earlier-harvested potatoes were lower than expected. Early harvesting occurred before the crop reached its full yield potential. Idaho growers planted 330,000 acres of potatoes this year, which is 35,000 acres more than they planted in 2022. Growers report that yields have been mixed. They have been exceptional in some fields, while others have produced average or below average yields. Overall, the state’s average yield is expected to be slightly above trend. If our forecast is accurate, Idaho’s production could exceed the 2022 crop by 22 to 24 percent. That would be Idaho’s largest potato crop on record.

Frozen processing supplies will also be plentiful in the Midwest processing states. Growers in Minnesota, North Dakota and Wisconsin are reporting above average yields for the 2023 crop. Midwest growers experienced some of the best harvest conditions in several years. Reports indicate that the 2023 crop is in good condition. Maine’s potato crop was in excellent condition early in the growing season. However, heavy rainfall during the late summer and harvest season negatively impacted the harvested area and quality of this year’s potato crop.

Canadian Supply Situation

Canada is expected to produce its largest potato crop on record. Bumper crops and expanded acreage in Alberta and Manitoba have resulted in an oversupply of potatoes for frozen processing. We expect combined production in Alberta and Manitoba to exceed the 2022 crop by 10 to 12 percent, even though growers destroyed several thousand acres of potatoes this year. In the eastern part of the country, production is expected to be down in Prince Edward Island, New Brunswick and Quebec. Crops in those provinces are likely to have more issues than usual with quality, size and storability. Recovery rates will be reduced due to low solids and other quality issues. Canadian processing potatoes could be moved from west to east to cover any supply gaps this year, as they have been in the past. In addition, U.S. fryers will not need to import processing potatoes from Canada this year. Overall, Canadian fryers should have more than enough raw product to run plants at capacity.

European Supply Situation

Growers in Belgium planted more potatoes this year than they did in 2022, while growers in Germany, the Netherlands and Poland reduced their planted area. France’s reported potato area is unchanged from a year ago. Current estimates are that the five major exporting countries planted a combined 2.29 million acres of potatoes this year, 0.7 percent less than they planted in 2022, according to World Potato Markets, a European publication.

Production estimates for Europe are variable. The EU’s MARS crop monitoring service expects yields to exceed 2022 levels in Belgium, Germany and France. However, they are projected to fall short of 2022 average yields in the Netherlands and Poland. Based on those acreage and yield estimates, the top five European exporting countries are expected to produce 781.7 million cwt of potatoes for the 2023 crop. That is 31.3 million cwt more than those countries produced in 2022, a 4.3 percent increase. Rain has slowed harvest progress across much of Europe. The challenging harvest conditions could negatively affect quality and reduce finished product recovery rates for the 2023 potato crop.

Impact on French Fry Sales and Consumption

Global French fry and other frozen product sales have been held back by raw product supply constraints during the past two years. That situation has reversed. Raw product supplies for both North American and European French fry plants will be up this year. North American frozen processors will have more than enough raw product to run plants at capacity. In addition, the quality of this year’s frozen processing potatoes appears to be excellent. Recovery rates have been above average. Global frozen product sales could increase substantially this year.

North American fryers could expand domestic and export sales during the 2023-24 processing season. French fry imports have made up for the shortfall in domestic production during the past three years. This year’s imports, through August, totaled 2.15 billion pounds. Exports of French fries and other frozen products totaled 1.29 billion pounds during the same eight-month period, creating a trade deficit of 860.7 million pounds. That follows a 534.3 million pound trade deficit in 2022 and a 238.2 million pound trade deficit in 2021.

Buyers and consumers may have gotten used to European products. They may be hesitant to change suppliers, or products, unless there are quality or price benefits. Raw product supplies will not be a limiting factor for North American fryers this year. That may give them the opportunity to expand domestic sales and re-capture some of the global French fry market.