|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

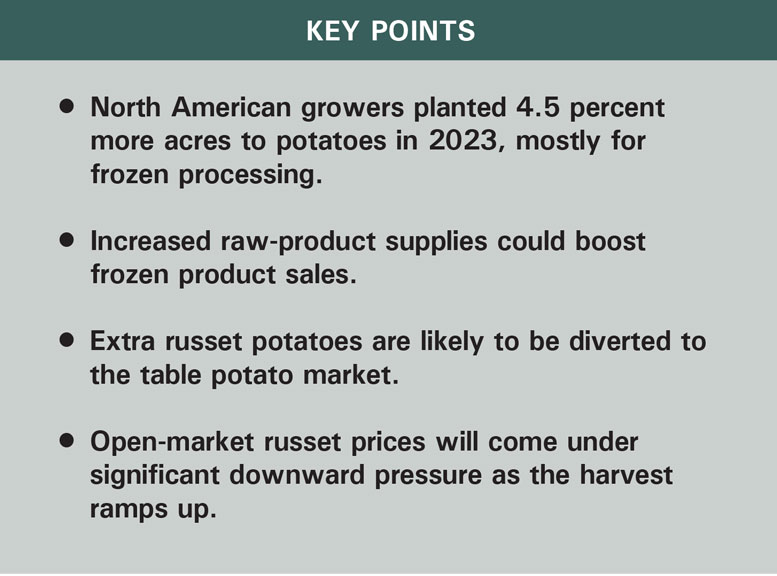

USDA reports that U.S. growers planted 949,000 acres to potatoes in 2023. That is 48,000 more acres than they planted a year ago, a 5.3 percent increase. Idaho’s acreage increase (+35,000 acres) accounted for 72.9 percent of the total U.S. expansion. Preliminary data from Canada show that growers in that country planted 396,922 acres to potatoes this year. That exceeded the 2022 area by 9,819 acres, a 2.5 percent increase. The combined North American potato area is 1.346 million acres, up 57,819 acres, or 4.5 percent, from the 2022 crop. Since 2020, Canadian potato acreage has expanded by 10 percent, while U.S. potato acreage increased 3.3 percent relative to 2020 levels. Overall, the total North American potato acreage is 66,600 acres more than it was for the 2020 crop.

Abandonment

USDA projects this year’s harvested potato area at 941,900 acres. That is 46,300 acres more than growers harvested in 2022, a 5.2 percent increase. A year ago, U.S. growers abandoned 5,400 acres of potatoes, 0.6 percent of the planted acreage. During the previous five years, abandonment has averaged 1.2 percent of the U.S. potato area.

Canadian growers abandoned 5,752 acres of potatoes during 2022, mostly due to heavy rainfall in the spring. That was 1.5 percent of all potatoes planted. Abandonment during 2018 and 2019 was 5.1 percent and 5.7 percent, respectively. Before those years, abandonment has averaged about 1.4 percent of the planted area. Because there have been very few reports of abandonment so far this growing season, we have held our estimate of Canadian abandonment at 1.5 percent. Canada’s 2023 harvested area would be 390,968.

Based on these harvested acreage estimates, the combined North American 2023 harvested acreage would be 1,332,868 acres, a 4.4 percent increase from 2022 levels.

Yields & Potential Production

The U.S. long-term trend yield is 460 cwt per acre. That is up from the current estimate for last year’s poor yield, 438 cwt per acre. Using the trend yield and projected abandonment, the U.S. would be expected to produce 433.3 million cwt of potatoes during 2023. That would be 41 million cwt more than 2022 production, a 10.5 percent increase. If realized, that would be the largest U.S. potato crop since 2000.

Canada’s average potato yield has increased by about 3.4 cwt per acre per year for the past 20 years. The trend yield for the 2023 crop is 322 cwt per acre. The current estimate for last year’s crop is also 322 cwt per acre. With a trend yield and estimated abandonment, Canada would produce a 125.9 million cwt crop during 2023. That would exceed 2022 production by 3 million cwt or 2.4 percent.

North American potato production will increase substantially, given this year’s acreage expansion. Estimated abandonment and trend yields suggest that North America’s 2023 potato crop could total 559.2 million cwt. That would exceed 2022 production by 44.1 million cwt or 8.6 percent. It also would be 32.3 million cwt or 6.1 percent more than the five-year average production for the U.S. and Canada combined.

Using trendline yields and average abandonment is a good place to start estimating total production. It only takes average growing conditions to produce a trendline yield. However, there are many other factors that can and will impact production between the time I write this article and the time you sit down to read it. A lot can happen before the harvest is complete.

After a cold spring, summer growing conditions have been mostly favorable across North America. Idaho’s potato crop was planted late, but summer growing conditions have been nearly ideal. Cold spring temperatures held back crop development and yields for Washington’s early varieties. Full-season yields are expected to increase relative to last year. So far, the western states and provinces have avoided the extended heatwave that lingered through most of the growing season last year. Growers in most Canadian provinces got a head start on planting. Timely rains have improved the yield outlook in several provinces, though parts of Quebec have received too much rain. Irrigation water supplies have been tight in Alberta. Processing potatoes in that province are about seven to 10 days ahead of schedule. Considering these factors, North American potato production could end up on either side of trend yield projections.

Absorbing Extra Production From 2023 Crop

Frozen processing raw product supplies have been extremely tight as the industry transitions to the 2023 crop. French fry and other frozen product sales have been strong, despite finished product price increases. Fryers increased Pacific Northwest contract volumes for the 2023 crop. Growers in Idaho, Washington and Alberta planted nearly 47,000 more acres to potatoes than they did a year ago, a 9 percent increase. Idaho and Washington increased potato acreage by 35,000 acres and 5,000 acres, respectively. Alberta planted 6,920 more acres to potatoes this year. Contract volumes and processing acreage appear to be relatively stable in other areas. This year’s acreage increase, coupled with stronger yields, will produce a large volume of open-market potatoes. Processors are likely to be more selective with potato quality and when purchasing production overages this year. Despite increased processing capacity, a substantial portion of those potatoes could be diverted to the dehy and table potato sectors.

Record prices have encouraged growers in Idaho, Washington and other areas to increase russet production. A return to trend yield, after last year’s challenging growing conditions, will significantly boost russet table potato supplies during the 2023-24 marketing year. In addition, Idaho’s continuing shift from Burbanks to Norkotahs could increase marketable supplies further. Growers in most Canadian provinces held their table potato acreage similar to 2022 levels. Open-market russet prices will face significant downward pressure during August and September as the harvest gets underway.

Summary

Most of this year’s extra planted acreage is for frozen processing potatoes. Several plants have expanded processing capacity, and they plan to source local raw product during the 2023-24 processing season. Raw-product supplies have constrained both domestic frozen product usage and French fry exports during the past two years. Frozen product sales are expected to increase significantly during the next 12 months. Processors could use a substantial portion of the extra production to meet increasing demand. However, extra supplies will likely be pushed onto the table potato market.