|

Click to listen to this article

|

Drivers include increased acres to support processor expansion, ongoing contract negotiations and record russet table prices.

Industry drivers

Northwest growing conditions and concerns

Potato growers benefitted from warm weather in late May and increasing grower returns. A cold, wet spring left Columbia Basin, Washington potatoes behind schedule, but 90°F days in late May allowed growth to catch up quickly. Growers in the Columbia Basin that can harvest potatoes early will benefit from strong processor demand. Washington State University Extension found Beet Leafhoppers (BLH), 0.125-inch-long insects, in over 90% of their test sites in the Columbia Basin. Despite the misleading name, BLH can also impact potatoes. While BLH can spread pathogens, testing found only 5% of insects were infected with a disease that could cause purple top and 34% carried the beet curly top virus. Leafhoppers can be a complicated pest and producers who find BLH in their fields should carefully consider both the risks and their options.

In Idaho, producers are concerned about yields and potato development. The late planting start and wet field conditions have delayed potato growth. Yields could also be impacted by seed supply issues which forced producers to plant available seed potatoes, even if they were lower quality than normal. Despite these challenges, growers remain optimistic, especially as Idaho’s irrigation supply significantly improved from 2022.

Ongoing contract negotiations

Potato contract negotiations have been ongoing in Idaho for the 2023 crop. Usually, negotiations are completed by February or March. However, producers are concerned that contracts, while higher than 2022, will provide too slim a margin with the ongoing volatility in production costs. Contract negotiations will likely finish in the next few weeks as growing conditions will reveal the quality and size of the new crop. If yields are lower than expected producers who waited to sign contracts will likely benefit from stronger prices.

Record Russet table prices

Russet table potato prices are at record highs supported by limited potato supplies and strong demand in all sectors (fresh, frozen and dehydrated). On June 7, 2023, russet table fresh weighted average prices (FWA) were more than double 2022’s price. Idaho Burbank’s FWA was $40.11 per cwt on June 7, up $23.44 per cwt from the previous year. The Columbia Basin had the strongest FWA prices in the nation at $42.36 per cwt, up 179% year over year. Since 2022, the Northwest FWA has outpaced the other major processing regions (San Luis Valley and Wisconsin). Prices tend to lag in the Northwest due to transportation costs, however strong processing demand and steep competition for any uncontracted potatoes have driven up FWA in the Northwest.

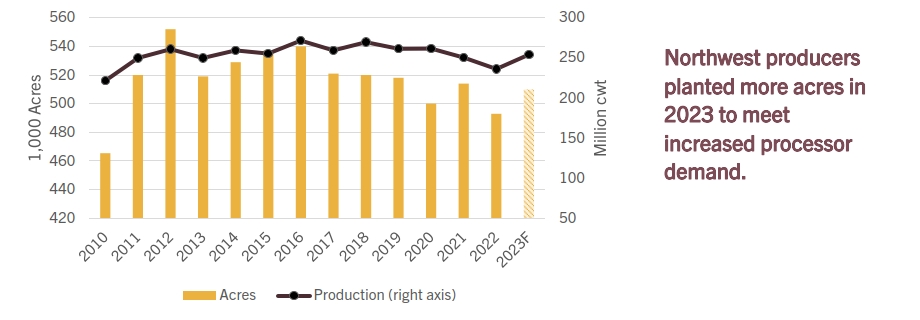

Processor demand and expansion drive acreage increases

Planted potato acres in the Northwest increased to accommodate greater processor demand and processor expansions. For two consecutive years, processors have had limited raw potato supplies. Supply shortages have led some processors to purchase and transport potatoes from the East Coast to fill in inventory gaps. This year, processors are expected to contract an additional 21,000 acres in the Northwest (up 4.3% year over year). National acres are forecasted up 3.4% from 2022 with Idaho and Washington leading the nation in increased acreage. Anecdotal reports also indicate that seed potato acres will increase due to the tight supplies this year and strong demand expected for seed potatoes in 2024.

Northwest potato annual planted acres and production, 2010-23F*

*Forecasted planted acre are based on industry standard estimates, average planted-to-harvest acre loss, and 3-year average yield (2019-2021).

*Northwest acres calculated for Idaho, Oregon, and Washington.

Limited potato supplies have constrained processors. Despite strong demand, some fryers and processors are concerned about potential July raw potato shortages. Idaho’s potato stocks were at their lowest April levels since 1990, down 12.5% year over year. Low potato inventories slowed processor volumes across the Northwest, down 16.3% year over year. Packing sheds are trying to limit the remaining potato supply to fryers and processors to avoid shortages like those that occurred last year. Processors have reduced production by taking days off to stretch remaining inventory. Some processors may have contracted growers to start digging potatoes in July. Early harvest is a near-term solution, but if overused, could create long-term cyclical potato production challenges. Ideally, the Northwest potato crop is large enough for potatoes in storage to sustain processor demand until harvest for the new crop begins the following July. Processors have secured more potato acres to alleviate the shortages experienced in 2021 and 2022, however, weather will likely be the greatest factor in the quality and size of the 2023 potato crop.

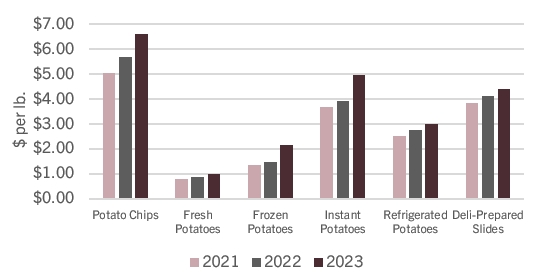

Higher fresh and retail prices lowered sales volume, but increased potato dollar sales

In the first quarter of 2023, potato retail sales increased, driven by higher fresh and retail prices. Prices for all potato categories rose with the average fresh potato price of $1.01 per lb., up 18.7% compared to the same timeframe in 2022. While higher prices benefited retail sales in total dollars, sales volume declined by 4.4% year over year. Decreased availability from a smaller national crop, down 2% year over year, also contributed to lower sales volume. Looking forward, an expected larger 2023 potato crop and reductions in food inflation should lower retail potato prices supporting greater sales volumes in 2023.

Retail potato prices by category, January – March

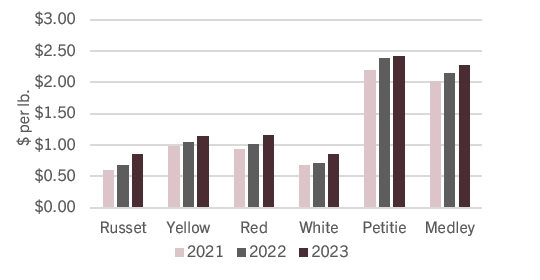

Fresh potato prices by type, January – March

Retail potato dollar sales increased, despite lower sales volume because of higher prices across all potato categories.

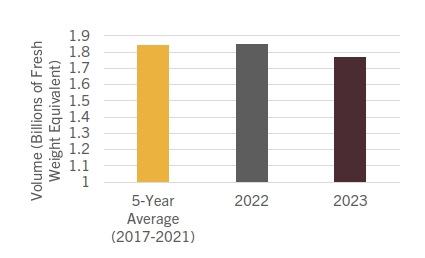

Retail potato sales volume, January – March

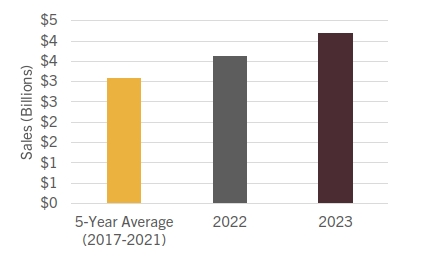

Retail potato dollar sales, January – March

Profitability

Potato growers are optimistic about the upcoming growing season despite input cost headwinds. The weather will largely determine the quality of the 2023 Northwest crop. So far, favorable weather has potato growers expecting good yields. For producers still in contract negotiations, strong yields could soften prices. Along the same sentiment, if the weather turns hot, yields could be lower and potato prices could remain high. Either way, prices are expected to be higher than 2022 which help reduce some of the higher production cost impacts, especially for producers that negotiate strong contract prices.