|

Click to listen to this article

|

By Kami Goodwin

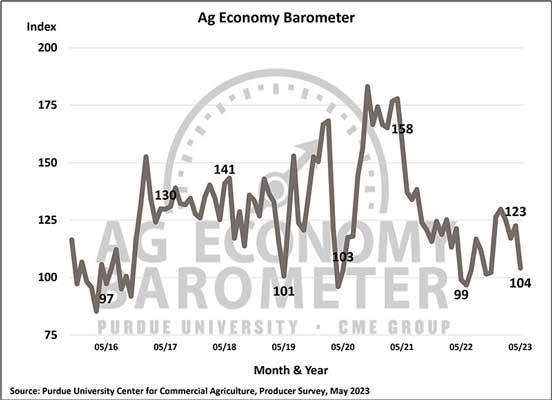

Producer sentiment fell to its weakest reading since July 2022 as the Purdue University/CME Group Ag Economy Barometer declined 19 points to a reading of 104 in May. The Index of Future Expectations was down 22 points to a reading of 98 in May, while the Index of Current Conditions was down 13 points to a reading of 116. This month’s lower sentiment was fueled by drops in both of the barometer’s sub-indices and likely triggered by weakened crop prices. In mid-May, Eastern Corn Belt fall delivery bids for corn fell over $0.50/bushel (10%), and soybean bids declined over $1.00/bushel (8%), while new crop June/July delivery wheat bids declined nearly $0.50/bushel (8%), all compared to bids available in mid-April, when last month’s barometer survey was conducted. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between May 15-19.

“Producers are feeling the squeeze from weakened crop prices, which has reduced their expectations for strong financial performance in the coming year,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Financial Performance Index was impacted by lower sentiment, dropping 17 points to a reading of 76 in May. Crop price weakness, uncertainty related to U.S. bank failures, and rising interest rates were likely key factors behind the decline. This month, 38% of respondents said they expect weaker financial performance for their farm this year, compared to just 23% who felt that way in April. Higher input cost remains the top concern among producers in the year ahead; however, concern over the risk of lower crop and/or livestock prices is growing. This month 26% of respondents chose lower output prices as their top concern, compared with just 8% of respondents who felt that way in September. Meanwhile, nearly three-fifths (59%) of producers said they expect interest rates to rise during the upcoming year, and 22% of respondents chose rising interest rates as a top concern for their farm in the next 12 months. Additionally, 40% of farmers in this month’s poll said they expect this spring’s U.S. bank failures to lead to some changes in farm loan terms in the upcoming year, possibly putting more financial pressure on their operations.

Unsurprisingly, the Farm Capital Investment Index was also lower, down 6 points to a reading of 37 in May. More than three-fourths (76%) of respondents continue to feel now is a bad time for large investments. Among those who feel now is a bad time, two-thirds (67%) cited rising interest rates and increased prices for machinery and new construction as key reasons.

Producers’ expectations for short-term farmland values fell 13 points to 110 in May and marked the weakest short-term index reading since August 2020. In this month’s survey, just 29% of respondents said they expect farmland values to rise over the next 12 months, compared to 54% who felt that way a year earlier. In contrast, producers remain more optimistic about the longer-term outlook for farmland values, as the Long-Term Farmland Value Expectations Index rose 3 points in May to a reading of 145.

With farm bill discussions ongoing, this month’s survey asked respondents what title in the upcoming legislation will be most important to their farming operation. Nearly half (48%) of producers said the Crop Insurance Title will be the most important aspect of a new farm bill to their farms, followed by the Commodity Title, chosen by 25% of respondents. In a follow-up question, corn and soybean growers were asked what change, if any, they expect to see to the Price Loss Coverage reference prices in a new farm bill. Close to half (45%) of corn and soybean growers said they expect Congress to establish higher reference prices for both crops, with very few (10% and 13%) expecting lower reference prices for soybeans and corn, respectively.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer.

SOURCE: PURDUE UNIVERSITY