|

Click to listen to this article

|

Northwest growers’ concerns about water availability have dissipated due to improved snowpack. Higher contract prices and improved growing conditions will support potato production. While strong demand is expected for the new crop, rising input costs weigh on producers’ profitability.

Industry drivers

Drought concerns for Northwest growers washed away

Planting in the Columbia Basin, Washington, started in early March with favorable weather conditions. In Idaho, water availability has dramatically improved. Last year, irrigation levels in southern Idaho ranged from 61%-80% of the seasonal average due to low snowpack. This year in mid-March, Idaho’s snowpack significantly improved water outlooks, dissipating growers’ concerns about water availability. While Idaho producers have delayed planting due to snow, in 2022 some areas were unable to plant until late April and still had favorable yields and size at harvest. With a short supply of remaining potatoes, there is strong demand for the 2023 crop.

Lower potato stocks mean fewer fries

Potato processors are still looking for enough raw product to meet the demand as they compete with table potato buyers and fryers for remaining potatoes. As a result, Northwest potato-growing states have experienced significant reductions in their February stocks, with Idaho stocks at 64.5 million cwt, down 10.4% year over year and the smallest inventory since 1990. Oregon’s and Washington’s February stocks fell by 7.7% and 5.0%, respectively. Processors have limited raw product supplies which hindered overall processing. In the Columbia Basin, Washington, supply constraints have limited processors who will operate at reduced capacity until July (when the 2023 harvest begins). The North American Potato Market News estimates that 2022 fry production declined by 2.2% annually, with potato supplies being the limiting factor. For 2023, fry production will increase as supply constraints ease and demand supports additional French fry production.

Slower shipments for remaining 2022 Northwest crop

Packers slowed their shipping pace to stretch the remaining potatoes supplies until the new crop is available in July. In Idaho, season-to-date shipments are 7% behind last year and will likely remain below 2022’s shipping pace. Demand for open market potatoes in Idaho is strong, but shipment volumes of available potatoes will depend on processor and dehydration demand. This winter, processors purchased potatoes from producers in the mid-$20 range per cwt. In the Columbia Basin, Washington, shipments were ahead of the seasonal average in mid-February. Shipments will decline throughout the spring as packing sheds’ inventories are low.

Export volume and value increase

U.S. potato exports increased in the last six months of 2022, supported by global market recovery and increases in shipments of frozen and dehydrated potatoes. Frozen potato shipments increased by 0.6%, supported by growth in Asian market exports. In contrast, U.S. fresh potato exports decreased in volume, while the value increased due to higher prices. Increased domestic demand for fresh potatoes and a smaller potato supply also factored into lower exports. As a result, 2022 potato export values were still robust despite higher costs and substantial exchange rate increases. While price increases remain a concern, 2023 will be a good year for potato exports supported by strong international demand.

Profitability

Potato growers should prepare for heightened production costs. Still, demand for potatoes is expected to be strong and higher prices will help sustain production in the face of increased expenses. The profitability of individual farms will be affected by marketing arrangements and the degree to which risk management tools, such as contracts, can help secure higher revenues or steady and lower costs. Therefore, it is crucial for potato producers to carefully consider their marketing strategies and use risk management tools to mitigate the impact of cost increases and maximize profitability.

Contract negotiations for Northwest growers remain ongoing. Idaho growers were in negotiation to contract for an 18%-22% increase above 2022 prices; however, growers voted not to accept the contract. Processors are now signing individual grower contracts.

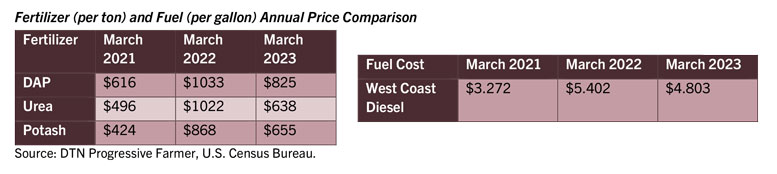

Producers will spend more money to produce potatoes as rising input costs weigh on their profitability. The main driver of the overall cost increase was fertilizer, followed by fuel, labor and inflation in most other categories. There has been some relief in fertilizer prices, but they remain elevated compared to 2021 prices. While fuel prices on the West Coast have decreased from their peak in October, they’re still up 7% compared to the previous year. Although the outlook for inflation is uncertain, at the March 2023 Federal Reserve Meeting, Chairman Powell indicated the federal interest rates will further increase in 2023, a likely indication of further inflation and higher production costs.