|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

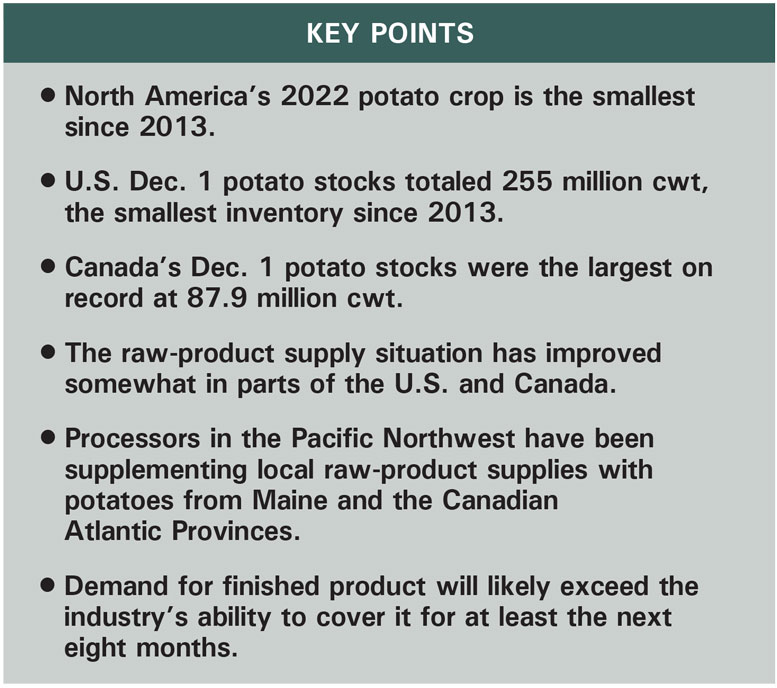

U.S. and Canadian growers produced 519.9 million cwt of potatoes during 2022. That is 12 million cwt, or 2.3 percent, less than 2021 production. The U.S. potato crop accounted for all the downturn. U.S. production is estimated to be down 3.2 percent from the 2021 crop. Canada’s 2022 crop is estimated to be 0.8 percent larger than last year’s record production. Dec. 1 stocks data, for both the U.S. and Canada, highlight several challenges and opportunities for the potato industry during the remainder of the storage season. In this article, we provide a brief outline of the raw-product supply situation for the North American frozen processing industry.

US Supply Situation

USDA estimates that potato growers produced 396.89 million cwt of potatoes during 2022. That is 12.94 million cwt less than the 2021 crop, a 3.2 percent decline. It is the smallest U.S. potato crop since 2010. Growers in the 11 states that traditionally have reported potato stocks held 255 million cwt of potatoes on Dec. 1. That is 8 million cwt less than those states had in storage a year ago, a 3 percent decline. It is the smallest Dec. 1 inventory since 2013.

USDA puts Idaho’s 2022 potato crop at 120.75 million cwt. That is 11.35 million cwt less than 2021 production, an 8.6 percent downturn. Idaho’s Dec. 1 potato stocks totaled 85 million cwt. That fell 7 million cwt short of the year-earlier inventory, a 7.6 percent decline. Idaho processors used 25.80 million cwt of potatoes from the 2022 crop prior to Dec. 1. That is 1.27 million cwt less than they used from the 2021 crop during the same period.

USDA reports that Washington growers produced 94.90 million cwt of potatoes in 2022. That is 2.98 million cwt more than the state produced in 2021, a 3.2 percent increase. Oregon’s 2022 potato crop totaled 25.31 million cwt, which is 969,000 cwt, or 3.7 percent, less than the 2021 crop. Combined Oregon-Washington potato stocks on Dec. 1 totaled 71.5 million cwt, according to USDA. That is 1.20 million cwt less than year-earlier holdings, a 1.7 percent decline. The Columbia Basin’s small carryover from the 2021 crop created the need for increased new-crop processing use, despite slow crop development. Processors used 36.63 million cwt of new-crop potatoes prior to Dec. 1. That is 1.71 million cwt more than they used during the same timeframe a year earlier. That may have included potatoes from outside the region.

Dec. 1 stocks in the other processing states are mixed. At 19.3 million cwt, Wisconsin’s reported Dec. 1 potato stocks fell by 500,000 cwt, 2.5 percent short of the year-earlier inventory. North Dakota had 16.5 million cwt of potatoes in storage on Dec. 1. That is 600,000 cwt less than the state held a year ago, a 3.5 percent decline. It is the second lowest inventory for this time of year since 2013. USDA reports that Maine had 15.3 million cwt of potatoes left in storage on Dec. 1. That is 1.7 million cwt more than the year-earlier inventory, a 12.5 percent increase. However, Maine’s production and stocks numbers do not seem to add up. This year’s Dec. 1 stocks are the largest reported since 1997. Minnesota had 15 million cwt of potatoes left in storage on Dec. 1. That is 2.5 million cwt more than it held a year earlier, a 20 percent increase.

U.S. processors used 64.28 million cwt of potatoes from the 2022 potato crop for purposes other than dehydration (mostly French fry production) prior to Dec. 1. That exceeded the 2021 pace by 531,000 cwt, or 0.8 percent. It followed a 23.4 percent decline reported for late-season usage from the 2021 crop. June-November disappearance in this category totaled 84.56 million cwt. That fell 5.66 million cwt, or 6.3 percent, short of June-November 2021 usage in the category. The drop in June-November processing for uses other than dehydration suggests that French fry production got off to a slow start. If the stocks data are accurate, it will be hard for fryers to pick up the pace during the remainder of the season. French fry plants in the Pacific Northwest currently are running below capacity due to raw product constraints. Plants in other parts of the country may be running at close to capacity.

Canadian Supply Situation

Canada’s 2022 potato crop is the largest on record. Canadian growers produced 123 million cwt of potatoes in 2022. That exceeded the 2021 crop by 956,000 cwt, or 0.8 percent. The country had 87.92 million cwt of potatoes in storage on Dec. 1. That exceeded year-earlier holdings by 462,000 cwt, a 0.5 percent increase. This year’s Dec. 1 inventory is the largest on record. All of the increase came in Alberta and Manitoba. Each of the other provinces posted reduced inventories on Dec. 1. Potatoes intended for processing saw the largest volume increase. Processing stocks rose by 1.52 million cwt, or 2.7 percent.

Alberta’s Dec. 1 potato stocks jumped 3.192 million cwt above 2021 holdings to a record 20.25 million cwt. Intended use data show that the province’s processing potato stocks rose by 2.511 million cwt to 14.769 million cwt, a 20.5 percent increase. Manitoba had 17.541 million cwt of potatoes in storage on Dec. 1. That is the largest Dec. 1 inventory since 2004. It includes 13.713 million cwt of processing potatoes. While Manitoba’s processing stocks are down 3 percent from last year, they are 10.7 percent above five-year average holdings. Ag Canada reported Quebec’s Dec. 1 inventory at 9.886 million cwt, down 846,000 cwt or 8.6 percent from last year. At 4.051 million cwt, processing stocks are down 0.7 percent from last year. New Brunswick had 11.59 million cwt of potatoes left in storage on Dec. 1. That is 1.042 million cwt less than the year-earlier inventory, an 8.3 percent decline. The province experienced a 710,000 cwt decline in its Dec. 1 processing potato inventory to 7.498 million cwt. The 8.7 percent decline leaves the province with its second lowest processing potato inventory since 2015. PEI held 22.25 million cwt of potatoes in storage on Dec. 1. That is 753,000 cwt less than year-earlier holdings, a 3.3 percent decline. PEI’s processing potato stocks exceeded the year-earlier inventory by 341,000, at 13.315 million cwt, a 2.6 percent increase. That is the island’s largest Dec. 1 processing potato inventory on record.

Though total production is up in both Alberta and Manitoba, those provinces do not have sufficient raw product to keep plants running at capacity. Processors in the Maritime Provinces and Quebec should have enough raw product to keep plants running at capacity. PEI and New Brunswick may have a surplus available for processors in other areas. Fryers in the Pacific Northwest have been purchasing potatoes from Canada’s Atlantic Provinces to cover this year’s supply gap. Raw-product supplies available to Canadian processing plants may be limited due to grower sales to processors in the Pacific Northwest.

Conclusion

The raw-product supply situation for the frozen processing sector has improved slightly, relative to last year, in some areas of the U.S. and Canada. However, production fell significantly below expectations in Idaho and the Columbia Basin. Given strong domestic and export demand for French fries and other frozen products, the raw-product supplies available are inadequate for local processing plant needs. Fryers have been purchasing open-market fry-quality potatoes in Idaho and the Columbia Basin. Given the tight supply of table potatoes this year, processors are unlikely to secure enough potatoes to meet their needs. Maine and the Canadian Atlantic Provinces have some extra supplies. Processors are moving those potatoes to plants in the Pacific Northwest to cover their raw-product supply gap. The quality of this year’s potato crop appears to be much better than it was in 2021, which should improve finished product recovery rates. However, demand for finished product is outstripping the industry’s ability to cover it due to raw-product supply constraints.