|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

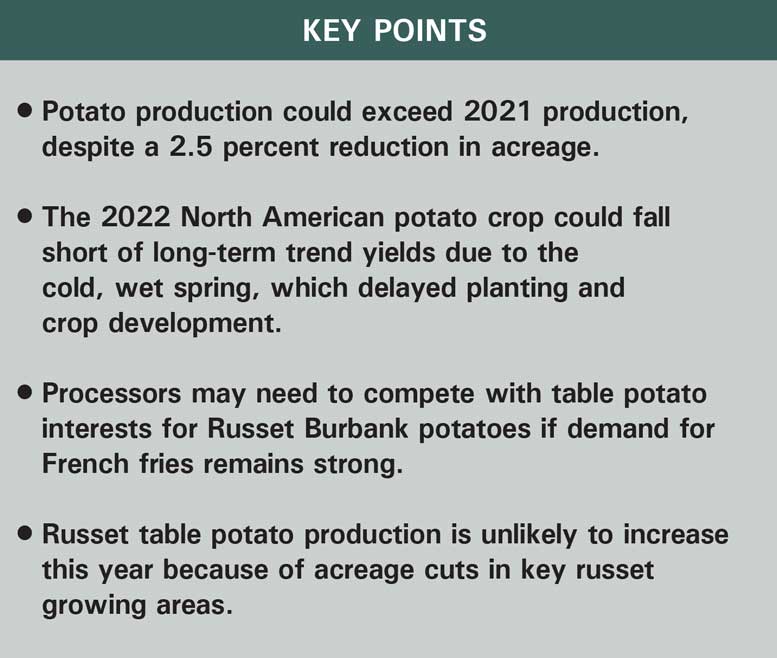

USDA reports that U.S. growers planted 910,000 acres to potatoes in 2022. That is 33,000 fewer acres than they planted a year ago, a 3.5 percent decline. Idaho’s acreage reduction (-25,000 acres) accounted for 75.8 percent of the total U.S. decline. Preliminary data from Canada show that growers in that country planted 385,128 acres to potatoes this year. That exceeded the 2021 area by 242 acres, a 0.1 percent increase. The combined North American potato area is 1.295 million acres, down 32,758 acres, or 2.5 percent, from the 2021 crop. Since 2019, Canadian potato acreage has expanded by 6.4 percent, while U.S. potato acreage remains 5.5 percent below 2019 levels. Overall, the total North American potato acreage fell 30,267 acres short of the 2019 crop.

Abandonment

USDA projects this year’s harvested potato area at 902,200 acres. That is 33,500 acres less than growers harvested in 2021, a 3.6 percent decline. A year ago, U.S. growers abandoned 7,300 acres of potatoes, 0.8 percent of the planted acreage. During the previous five years, abandonment has averaged 1.1 percent of the U.S. potato area.

Canadian growers abandoned only 2,974 acres of potatoes during 2021, mostly due to adverse harvest conditions. That was 0.8 percent of all potatoes planted. In 2020, abandonment totaled 4,266 acres, or 1.2 percent of the crop. Abandonment during 2018 and 2019 was 5.2 percent and 5.6 percent, respectively. Before those years, abandonment has averaged 1.4 percent of the planted area.

Because there have already been several reports of abandonment, due to heavy rainfall this spring, we have increased our estimate of Canadian abandonment to 2.5 percent. Canada’s 2022 harvested area would be 375,500. Based on these harvested acreage estimates, the combined North American 2022 harvested acreage would be 1,277,700 acres, a 3 percent reduction from 2021 levels.

Yields, Potential Production

The U.S. long-term trend yield is 466 cwt per acre. That is up from the current estimate for last year’s poor yield, 438 cwt per acre. Using the trend yield and projected abandonment, the U.S. would be expected to produce 420.4 million cwt of potatoes during 2022. That would be 10.7 million cwt more than 2021 production, a 2.6 percent increase. It would match 2020 production and fall 4 million cwt, or 0.9 percent short of 2019 production.

Canada’s average potato yield has increased by about 3.5 cwt per acre per year for the past 20 years. The trend yield for the 2022 crop is 323 cwt per acre. The current estimate for last year’s crop is 322 cwt per acre. With a trend yield and estimated abandonment, Canada would produce a 121.1 million cwt crop during 2022. That would fall 1.9 million cwt short of 2021 production, a 1.5 percent decline.

North American potato production could increase despite this year’s overall reduction in acreage. Estimated abandonment and trend yields suggest that North America’s 2022 potato crop could total 541.5 million cwt. That would exceed 2021 production by 9 million cwt or 1.7 percent. It also would be 1.3 million cwt or 0.2 percent more than the five-year average production for the U.S. and Canada combined. Using trendline yields and average abandonment is a good place to start estimating total production. It only takes average growing conditions to produce a trendline yield. However, there are many other factors that can and will impact production between the time I write this article and the time you sit down to read it. A lot can happen before the harvest is complete.

Planting and crop development got off to a slow start in nearly all the major growing regions this spring. Cold, wet weather made planting difficult and has delayed crop development. Heavy spring rainfall has caused some damage in low-lying areas. Though crops were planted later than usual, many areas have experienced nearly ideal growing conditions through July, which has allowed crops to catch up a little. Moisture conditions have improved from last year in the Red River Valley and in the Prairie Provinces.

So far, the western states and provinces have avoided the early-season heat wave that lingered through most of the growing season last year. Nevertheless, the last half of July was extremely hot in the Pacific Northwest and Alberta, Canada. Potatoes should be more resilient at that point, but probably have not been unscathed.

Some states are reporting excellent crops while others expect yield reductions because of slower crop development. The full impact of the cold, wet spring on the 2022 crop remains to be seen. Considering these factors, North American potato production could end up on either side of trend yield projections.

Supply and Demand Issues

Frozen processing raw product supplies have been extremely tight as the industry transitions to 2022-crop potatoes. French fry and other frozen product sales have been strong, despite significant finished product price increases. Contract volumes are up from 2021 in the major processing states and provinces. Alberta and Manitoba planted 5,350 more acres to potatoes this year. On the other hand, total acreage for Washington, Idaho and North Dakota is down 23,000 acres from last year.

Unless yields are significantly reduced, Canadian fryers should have sufficient raw product from the 2022 crop to utilize their processing capacity. In contrast, U.S. fryers have the capacity to run more product than they have under contract. Yields have been reduced on early-harvested varieties due to cold spring weather. Yields are likely to improve for later frozen processing potatoes. Nevertheless, fryers may need to pick up open market potatoes if French fry demand remains strong.

Russet table potato production is unlikely to increase this year. Idaho and Wisconsin both planted fewer russet table potatoes than they planted in 2021. The Columbia Basin and the Klamath Basin also experienced acreage cuts. If yields in the major production areas meet trend levels, the industry could produce an adequate supply of russets. However, the cold, wet spring might put a damper on yields. In addition, fryers and dehydrators may need to purchase potatoes intended for other market channels. This could tighten russet table supplies significantly.

In the past, potato demand has been relatively stable. Shifting supply typically has been the primary factor driving potato prices. Inflation and the economic recession are likely to impact the market sectors differently. The size of this year’s potato crop and additional influences on demand are certain to cause supply and demand challenges and opportunities for the 2022 potato crop.