|

Click to listen to this article

|

By Ben Eborn, Publisher, North American Potato Market News

Growers are busy planting the 2022 crop now. Planting decisions may have been more challenging this year than they have been in the past. Production costs are rising rapidly. Inflation is higher than it has been in 40 years. Crop prices have been extremely volatile. There is no shortage of uncertainty going into the 2022 crop year. In this article, we review some of this year’s challenges and opportunities: production costs, food inflation and potato prices for the 2022 marketing year.

Production Costs Continue to Climb

Nailing down production costs this spring has been like trying to buckle a 2-year-old child into a car seat. This year, the global crop input supply situation has been rattled by inflation and war. Growers have been struggling with rapidly rising production costs for the past two years. Input costs for the 2021 crop increased by approximately 15 percent to 20 percent per acre. Though prices are constantly changing, early estimates indicate that input costs could jump another 18-22 percent or more for the 2022 crop.

Prices for fuel, fertilizer, chemicals and repairs have surged. Labor supplies are short, and growers have had to increase wages to keep employees. In addition, rising interest rates will contribute to the overall increases in costs. If 2022 crop yields return to trendline, that could increase total production costs by $0.60 to $2 per cwt. Break-even prices to the grower will take another big jump in 2022.

Food Inflation on the Rise

The average U.S. price of food jumped 7.9 percent during the year ending Feb. 28, 2022, according to the U.S. Bureau of Labor Statistics. That is the largest food inflation surge since 1981. During that same timeframe, “food away from home” and “food at home” prices increased by 6.8 percent and 8.6 percent, respectively. Overall, food inflation has averaged 2 percent for the previous decade (2012-2021).

Food inflation projections for the next few years vary widely. The Russia-Ukraine war has added a new level of uncertainty to the equation. Typically, one-fourth of the world’s wheat supply comes from the region. Though that wheat does not directly affect U.S. markets, as we have seen recently, it can have a large indirect impact on U.S. and global wheat prices. Higher wheat prices have a ripple effect throughout the food industry. Rising production costs combined with the disruption in the world’s wheat supply are likely to translate into higher-than-normal food inflation, which could continue for the next several years.

Lessons Learned From the 2021 Marketing Year

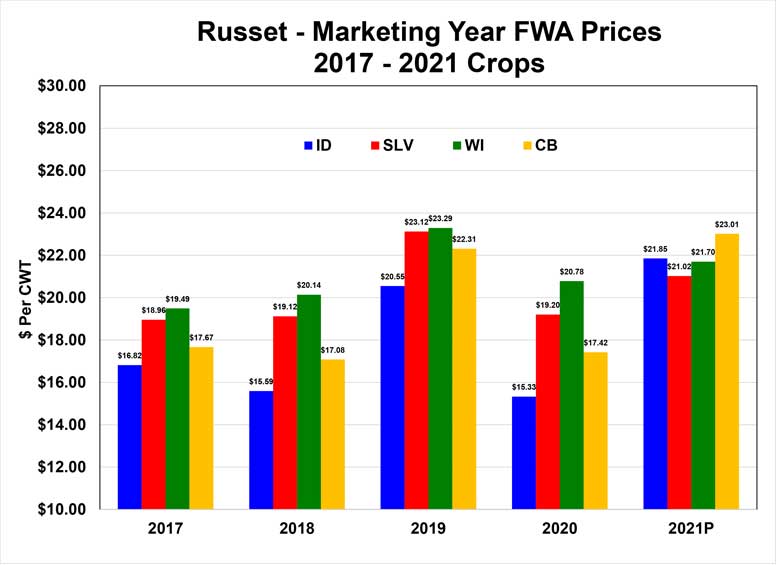

Figure 1 shows the marketing year fresh weighted average prices (FWA) for russet table potatoes in Idaho, the San Luis Valley, Wisconsin and the Columbia Basin over the past five years. The 2021 prices are preliminary through March 16, 2022 (press time). There are several interesting things to point out with prices for the 2021 crop.

First, Idaho and Columbia Basin prices have outpaced San Luis Valley and Wisconsin prices for the first time in modern history. Prices in the Pacific Northwest usually lag behind other areas, partially due to transportation costs. However, prices for the 2021 crop have exceeded those from other areas despite skyrocketing transportation costs this year. Strong frozen processing demand for open market russets combined with the region’s smallest potato crop in more than a decade have supported strong prices.

Second, prices for the 2021 crop appear to be meeting some resistance at the 2019 price level. Idaho and Columbia Basin shippers have been able to break through that resistance. Though movement from Idaho and the Columbia Basin has been slow this year, the region will likely have little to no carryover from the 2021 crop. Shippers in the San Luis Valley and Wisconsin held back on price increases for the first half of the season. Their marketing year average prices could remain $1 to $2 per cwt below 2019 levels. Shippers will be challenged to increase prices above that resistance level in 2022.

Most importantly, the chart illustrates that pricing patterns can be broken. The 2017-2020 price patterns are very similar, though the price range varies from year to year. During that timeframe (and many years before), Idaho prices have been at the bottom, followed by the Columbia Basin. Wisconsin has always held the top spot, with the San Luis Valley not far behind. The typical pricing pattern may return for the 2022 marketing year, but it will need to shift upward if prices are to remain profitable for growers.

Will Potato Prices Keep Up?

Potatoes are a staple item in the American diet. Consumers have become accustomed to potatoes as a relatively inexpensive part of their food purchases. Fresh shippers will likely face some resistance when it comes to increasing prices for the 2022 crop, especially if yields rebound and the industry is challenged to market a much larger crop. The industry will need to make a significant pricing shift upward for the 2022 crop. Nevertheless, if shippers are unable to increase potato prices with general food inflation and rising production costs, growers could receive prices well below breakeven.