|

Click to listen to this article

|

by Dan Manternach, Senior Ag Economist, CommStock Investments, Inc.

Ag Secretary Vilsack has called for the USDA to conduct an investigation into skyrocketing costs for farm inputs, such as fertilizer and crop protection products. It begins with a 60-day comment period seeking input from stakeholders. Vilsack summed up the situation well by stating “As I talk with farmers and other stakeholders, I keep hearing significant concerns about whether large companies along the supply chain are taking advantage of the situation by increasing profits and not just passing along higher costs.”

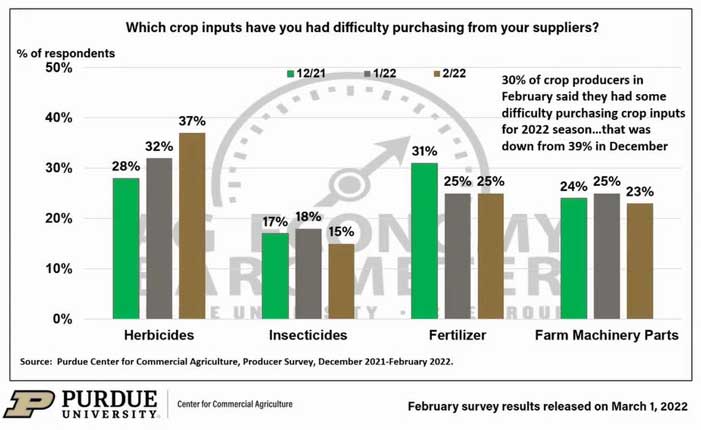

He’s not blowing smoke about the scope of the problem. Purdue University polls farmers across the country monthly on a variety of key issues costing them money and sleep at night. They display results in a series they call their Ag Economy Barometer. February survey results for one of the questions asked are telling: “Which crop inputs have you had difficulty purchasing from suppliers?”

Notice that important herbicides top the list, rising even further in February, to 37% of respondents. Next was fertilizer at 25%, then farm machinery parts, and then insecticides at 15%, down just a bit from December and January readings. However, Jeff Stow, President of the online input marketplace FarmTrade.com warns the insecticide woes could still be ahead. Why? “Because a lot of farmers only buy their insecticides and fungicides as needed.”

Supply crisis “explanations” sound more like “excuses” to Stow, who addressed them one by one in an interview where I asked for his take on them as one among the “stakeholders” Vilsack referenced in announcing USDA’s investigation plans.

* Explanation 1: Ag chem companies focused on clearing inventory in years leading up to 2020, blaming stagnant crop prices and high costs of storing inventory. Stow told me “Here at FarmTrade, we took steps to ensure that all our vendors understood that any product they sold on our platform had to be a product they had on hand. Once the farmer buys, we move quickly to get the order on the road to him.”

* Explanation 2: Tariffs rose for imported crop input products, especially post-patent chemicals. Stow told me “While true some imported products have tariffs, prices didn’t rise substantially until the summer of 2021. While the tarrifs play a role in the price increases, I don’t believe they are the driving force.”

* Explanation 3: Freight costs and truck driver shortages created huge problems for farmer customers of companies relying on “just in time” delivery schedules. Stow’s take? “Nobody can argue that’s an issue for low value cargo shipped a long way. But relative to the high value of herbicides and other input products you can pack on a truck, the extra freight cost is minor compared to the price spikes we’ve seen blamed on them. The worst freight cost hikes have been for ocean-shipping and here at FarmTrade, we are not involved in the shipping process prior to the inputs arriving in the United States.”

Most analysts see input price increases to continue through 2022

Read the whole report here.