By Bruce Huffaker, Publisher, North American Potato Market News

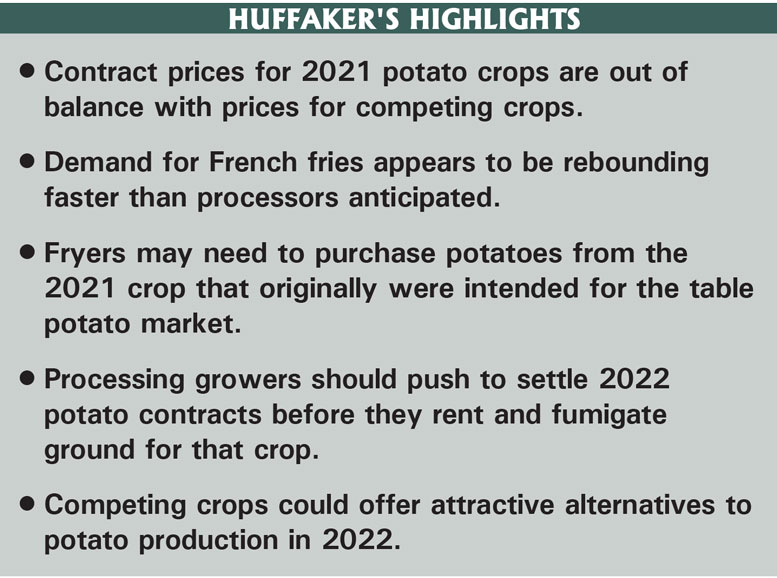

North American French fry processors have taken conservative positions on their 2021 raw product contracts. In most cases, processing volumes are up from 2020 levels, but not yet back to 2019 volumes. The fryers managed to negotiate 3 percent price reductions in the Pacific Northwest, but reports indicate that contract prices increased by 1 percent to 3 percent in other parts of the U.S. and across Canada. Meanwhile, production costs had increased by at least 7 percent by planting time, though growers may have been able to lock in lower prices on inputs purchased in advance. Prices for competing crops have been soaring. Demand for French fries appears to be rebounding faster than processors anticipated. Distributors are reporting the largest French fry price increases they have experienced in many years. These cross currents point to major challenges for the 2021-22 processing season, as well as for negotiating 2022 raw product contracts.

Potato Prices

Contract price reductions in the Pacific Northwest highlight the challenges for processing growers when russet table potato prices are low. Grower returns on Idaho table potatoes have been running below production costs since the 2020 harvest wrapped up. Columbia Basin prices have been only marginally better. The low prices made many table potato growers hungry for processing contracts, leading to more demand for the contracts than fryers needed to fill their projected usage.

Growers in other parts of the U.S., either where table potato prices were stronger or where there is no competition between table and processing growers, were able to negotiate small price hikes, though the low western prices limited the increases to less than the increased production costs.

To the extent that Canadian growers’ production costs are linked to the U.S. dollar, they made out much better than their U.S. counterparts. Though nominal price increases were similar to those in the U.S., the Canadian dollar appreciated in value by 12.4 percent between April 2020 and April 2021.

Supply and Demand

While information on demand paints a mixed picture, reports indicate that processors are confident enough to boost prices for finished product. By April 30, processors had reduced their finished-product inventories to the lowest level on record, relative to usage, for that time of the year. Though processors complain that container shortages have limited offshore movement, exports have been running close to record levels in recent months.

European processors’ business has not returned to pre-pandemic levels, but it appears that most of the European crop surplus has been converted to either bio-fuel, cattle feed or alcohol. Nevertheless, competition from European product remains a challenge due to limited demand within the European Union.

Fryers might need significant volumes of open potatoes from the 2021 potato crop. They may be hoping to pick up those potatoes at less than contract price; however, that strategy is dependent upon expectations that growers planted more potatoes than they had under contract and/or that yields will surpass the long-term trend. Official acreage data will not be available until June 30, long after our press deadline, but initial indications on planting are mixed. Growers had a substantial investment in the 2021 crop before contract prices and volumes were established. Smaller growers may not have been able to adjust acreage to come in line with contract volumes because such adjustments would have involved partial fields. On the other hand, prices for competing crops soared ahead of the 2021 planting season, while potato prices were flat to lower. That increased incentives for growers to limit their potato acreage, particularly since they had the opportunity to lock in prices for many of the competing crops.

Future Uncertainty

Expect increased uncertainty in potato markets for the next several months. That will be driven by several questions that go beyond the normal seasonal fluctuations: 1) How fast will global demand rebound to pre-pandemic levels? 2) Have growers planted enough potatoes (both in North America and globally) to cover demand? 3) Will prices for competing crops pull ground away from potato production in 2022?

The global demand outlook is extremely volatile. Between 2003 and 2019, global French fry sales to customers outside of major producing areas grew an average of 5.1 percent per year, reaching a peak of 16.8 billion pounds in 2019. Pandemic-related disruptions resulted in a downturn in trade for the first time on record during the 12 months ending July 31, 2020, a 5.4 percent decline. From August 2020 through January 2021, global trade was running 8.2 percent behind the previous year’s pace. Since Jan. 1, offshore exports from non-EU sources have been running 2.7 percent ahead of last year’s pace. Complete EU trade data are not available, but limited information indicates that EU external exports are on a similar trajectory, while EU internal sales remain weak.

As pandemic-related restrictions are lifted in the coming months, we expect French fry sales to rebound to the pre-pandemic trajectory. That is, global trade for the year ending July 31, 2022, could reach 18 billion to 18.6 billion pounds, up 7 percent to 11 percent, relative to the pre-pandemic peak. Domestic consumption within North America and the EU also can be expected to exceed pre-pandemic levels, though not by as large of a margin. However, it is important to remember that these demand projections are contingent on keeping COVID-19 under control and reopening economies around the globe.

European observers report acreage cuts in the major French fry producing countries this year. North American acreage is up but may not be back to pre-pandemic levels. Those adjustments suggest that the industry will either have to depend on yield increases or pull potatoes from other industry sectors to meet our demand projections for the coming season.

Volatile prices for competing crops complicate the outlook for 2022 processing contracts. Grain futures prices have backed off since peaking in early May. Had those prices continued to rise, processors would have been forced to lock in contracts for 2022 this summer to encourage growers to rent and fumigate ground for the 2022 crop. Grain crops could rebound as the summer progresses. Growers may need to pay higher rent for the coming year to lock in the ground for the crops that processors need. That could result in early contract settlements for the first time since 2008. Growers will be looking for substantial price increases to cover their costs. Unless they get those increases, growers may be tempted to pass on renting potato ground for the coming year, or they may opt to grow crops that cost less to produce and offer better per-acre returns than current potato contract prices can generate.