By Bruce Huffaker, Publisher, North American Potato Market News

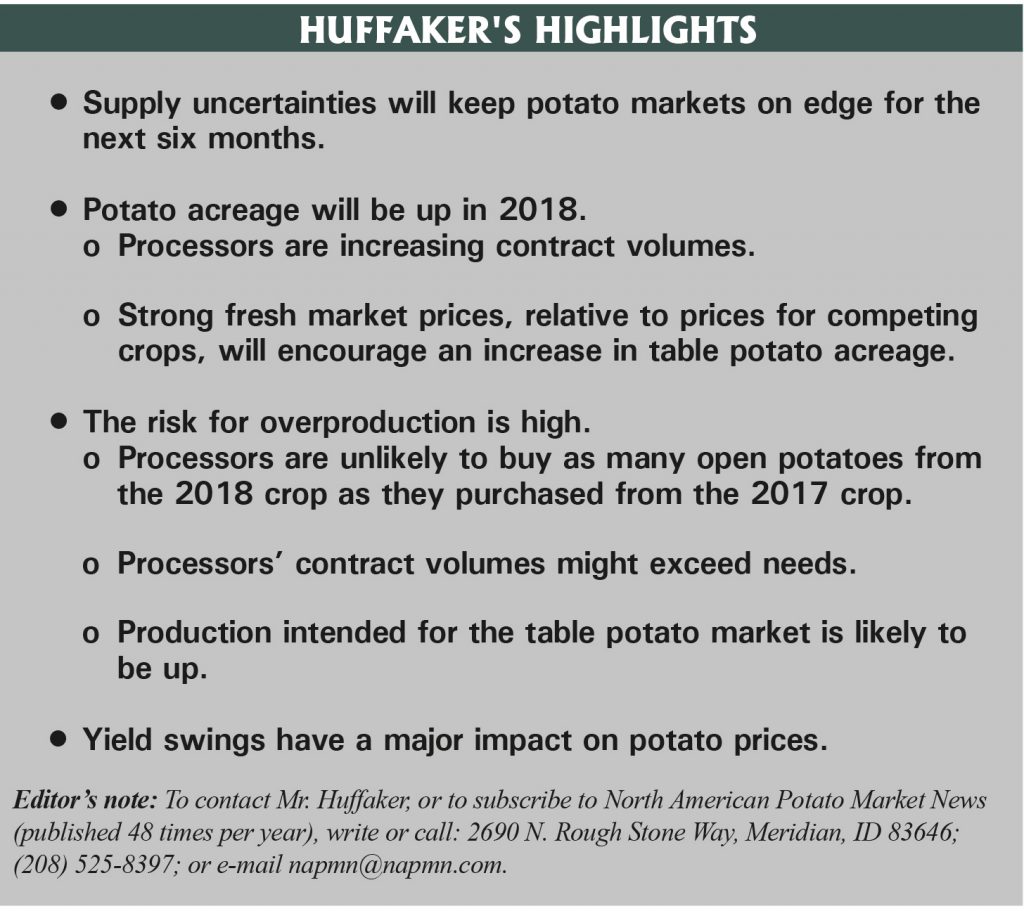

Grower returns on russet table potatoes are exceeding production costs for the first time since the 2013 crop. Returns on red and yellow table potatoes also are respectable, though they are down from year-earlier levels. Processors are scrambling to find enough raw product to keep their customers supplied until the 2018 harvest gets underway. Chip potatoes are the only industry sector where demand for open potatoes appears to be limited. Even there, growers are likely to find a home for the extra potatoes. The challenge for the industry will be to maintain a reasonable balance between potato supplies and demand through the remainder of the 2017 crop year and throughout the 2018 crop year.

Does the industry have enough potatoes to maintain the current usage pace for the remainder of the 2017-crop storage season? Will processors overreact to this year’s production shortfall by contracting for too many potatoes from the 2018 crop? Will new processing lines be able to run at capacity, or will the ramp-up take longer than anticipated? How many potatoes will table potato growers plant? How far will yields exceed or fall short of the long-term trend? The answers to those questions will go a long way toward determining market behavior during the next 18 months.

Supply Uncertainties

USDA reports that growers had 264.2 million cwt of fall potatoes in storage on Dec. 1. That is 8.8 million cwt less than they held at the same time in 2016, a 3.2 percent decline. Evidence suggests that the stocks numbers may be inflated, particularly in the upper Midwest. Usage has fallen short of last year’s pace, but questions remain as to how much the industry needs to cut back during the next six months, which industry sectors need to make the cuts and how much buyers intend to rely on a quick start to the 2018 harvest to mitigate the impact of the 2017-crop shortfall.

Current market prices for table potatoes indicate either that the demand structure for potatoes has changed over the past four years, or that USDA’s stocks data are overstated. Reported Dec. 1 stocks are 0.6 percent lower than they were for the 2014 crop. However, reported fresh potato shipments for the 2017 crop fell 0.9 percent short of the 2014 pace. Processing use was down 6 percent, while chipstock movement declined 9 percent. Shifts in the regional distribution of stocks might be affecting prices. Stocks in the Pacific Northwest are 2.6 percent below 2014 levels while stocks in the upper Midwest are up 2.9 percent. However, that is not sufficient to support this year’s price premiums relative to the 2014 crop. Average russet shipping point prices are running between 19 percent and 36 percent higher than they were for the 2014 crop. Red potato prices are up 31 percent. Yellow potato prices are only up 7 percent, but that increase comes despite a 36 percent increase in movement.

If USDA has overstated this year’s potato stocks, the market for open potatoes could be explosive during the next six months. On the other hand, if the stocks data are accurate, an early spring, together with heavy planting of early potatoes, could encourage growers to move storage potatoes more quickly than normal, which could drag prices down.

Acreage Increase

Potato acreage almost certainly will increase in 2018. Processors will be gearing up production on new processing lines throughout the Northwest. They are contracting for extra potatoes to fill that capacity. Observers believe that those lines will require close to 6,000 acres more potatoes in the Columbia Basin and up to 15,000 acres in Idaho. In addition, we expect processors to contract for more early potatoes to mitigate the supply shortfall from the 2017 crop. A combination of factors prompted dehydrators to cut back on field-run contracts in 2017. Those decisions resulted in a raw-product supply shortfall for dehydrators. If history is any indication, dehydrators may contract for more field-run potatoes than they need in 2018, as they overreact to the current supply shortfall. Added to that, table potato production is profitable this year, and potatoes are offering much better returns than competing field crops. The combination of those factors will make it difficult to keep potato supplies in a profitable balance with demand for the 2018 crop.

Yields are the wild card for potato pricing. Yields have been in a relentless uptrend since World War II. Nevertheless, deviations around the trend are significant enough to create shortages and surpluses. Over the past 20 years, yields have ranged between 15 cwt per acre below the trend and 15 cwt above the trend. That is roughly +/- 15 million cwt, about 3.5 percent of production. Shifts of that magnitude have proven to be sufficient to result in wide swings in prices for open potatoes.

Risk of Overproduction

In addition to yield risk, potato markets face the potential for challenges in the demand category. As noted earlier, processors could overreact to this year’s supply shortfall by contracting for too many potatoes. They have several options when that happens. They can use the extra potatoes to reduce raw product needs from the next crop, they can divert the extra potatoes to the table potato market, or they can move the surplus to cattle feed or other alternative markets. Like any rational player, the processors pick the option that offers the best return or minimizes losses. When potatoes are diverted to the fresh market, they depress open market prices. That usually creates a bigger problem for table potato growers than for processors or their growers, as table potato growers tend to have more exposure to the open market.

New processing lines add to the uncertainty for 2018 pricing. Fryers are contracting for raw product to fully utilize those lines. If it takes longer than anticipated to ramp up that production, some of those potatoes could work their way into the fresh market or need to be disposed of in other ways. In either case, they have the potential to weigh on prices for open market potatoes.

The uncertainties surrounding 2018-crop supplies and demand make it imperative that table potato growers exercise caution with their planting plans. Current prices are a signal that the market needs more table potatoes during the coming year. However, changes in contract volumes could free up enough potatoes to meet most, if not all, of those needs. Even if contract volumes do not exceed usage requirements, processors are unlikely to buy as many open potatoes as they purchased from the 2017 crop. The potential for returns on table potatoes to fall below production costs for the 2018 crop is substantial.